2025 CATGPT Price Prediction: Potential Surge to $50 Amid Growing AI Adoption and Market Expansion

Introduction: CATGPT's Market Position and Investment Value

CatGPT (CATGPT), as a meme token on the Solana blockchain, has been serving as a unique community token project since its inception. As of 2025, CatGPT's market capitalization has reached $738,045, with a circulating supply of approximately 5,250,000,000 tokens, and a price hovering around $0.00014058. This asset, dubbed the "soul companion of the community," is playing an increasingly crucial role in fostering community engagement and meme culture within the cryptocurrency space.

This article will comprehensively analyze CatGPT's price trends from 2025 to 2030, combining historical patterns, market supply and demand, ecosystem development, and macroeconomic factors to provide investors with professional price predictions and practical investment strategies.

I. CATGPT Price History Review and Current Market Status

CATGPT Historical Price Evolution

- 2024: Project launch, price reached ATH of $0.006388 on April 26

- 2025: Market correction, price dropped to ATL of $0.0000717 on April 7

CATGPT Current Market Situation

As of October 30, 2025, CATGPT is trading at $0.00014058. The token has shown mixed performance across different time frames. In the past 24 hours, CATGPT has gained 1.27%, with a trading volume of $27,137.34. The short-term trend appears positive, with a 1.66% increase in the last hour and a 7.67% gain over the past week. However, the longer-term outlook is less favorable, as CATGPT has declined by 9.44% in the last 30 days and 28.02% over the past year.

CATGPT's market capitalization currently stands at $738,045, ranking it 3,115th in the overall cryptocurrency market. The token's circulating supply is 5,250,000,000 CATGPT, which represents 35% of its maximum supply of 15,000,000,000 tokens. The fully diluted valuation of CATGPT is $2,108,700.

Despite recent gains, CATGPT is still trading significantly below its all-time high of $0.006388, recorded on April 26, 2024. The current price represents a 97.8% decrease from this peak. However, it has shown recovery from its all-time low of $0.0000717, set on April 7, 2025, with a 96% increase from this bottom.

Click to view the current CATGPT market price

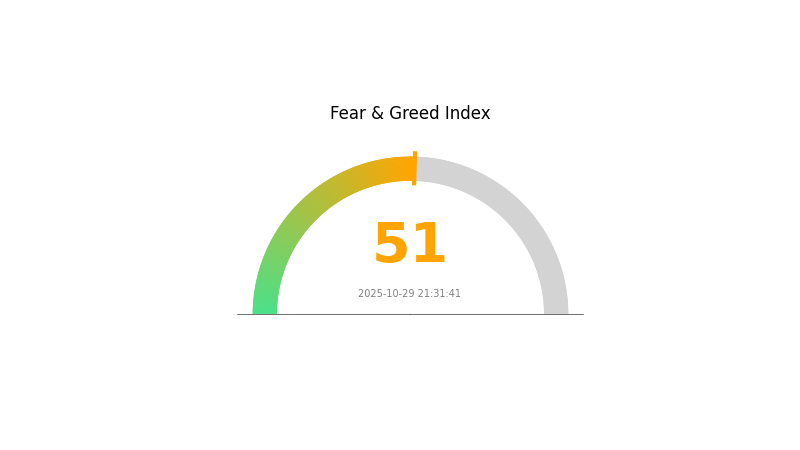

CATGPT Market Sentiment Indicator

2025-10-29 Fear and Greed Index: 51 (Neutral)

Click to view the current Fear & Greed Index

The crypto market sentiment remains balanced as we approach the end of October 2025. With a Fear and Greed Index of 51, investors are showing a cautious yet optimistic outlook. This neutral stance suggests a potential equilibrium between buying and selling pressures. Traders should remain vigilant, as such periods often precede significant market movements. Keep an eye on key technical indicators and news developments that could sway sentiment in either direction. As always, practice risk management and consider diversifying your portfolio on Gate.com to navigate these market conditions effectively.

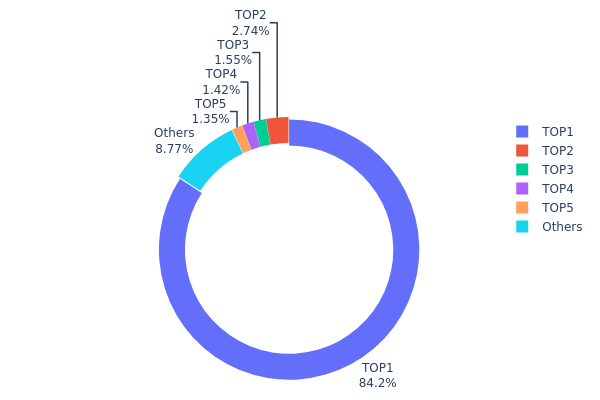

CATGPT Holdings Distribution

The address holdings distribution data for CATGPT reveals a highly concentrated ownership structure. The top address holds an overwhelming 84.16% of the total supply, equivalent to 4,065,565.92K tokens. This extreme concentration raises significant concerns about centralization and potential market manipulation.

The next four largest addresses collectively hold only 7.05% of the supply, with individual holdings ranging from 1.34% to 2.74%. The remaining 8.79% is distributed among other addresses. This skewed distribution indicates a lack of widespread token dispersion and potentially limits the project's decentralization efforts.

Such a concentrated holding pattern could lead to increased price volatility and susceptibility to large sell-offs or buy-ins initiated by the dominant address. It also poses risks to the overall market stability and may deter smaller investors due to concerns about price manipulation. The current distribution suggests that CATGPT's on-chain structure and market dynamics are largely influenced by a single entity, which could impact its long-term sustainability and adoption.

Click to view the current CATGPT Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 5Q544f...pge4j1 | 4065565.92K | 84.16% |

| 2 | u6PJ8D...ynXq2w | 132516.02K | 2.74% |

| 3 | A77HEr...oZ4RiR | 75018.40K | 1.55% |

| 4 | 4edK8V...JQRUjc | 68729.42K | 1.42% |

| 5 | ACQBmC...48NFid | 65014.19K | 1.34% |

| - | Others | 423618.56K | 8.79% |

II. Key Factors Influencing CATGPT's Future Price

Supply Mechanism

- Market Sentiment: Investor sentiment and confidence have a direct impact on CATGPT price movements. News about widespread adoption or major technological breakthroughs can significantly influence the market.

Institutional and Whale Dynamics

- Corporate Adoption: Major industrial companies are integrating AI models into their software for production line data analysis and anomaly reporting. For example, Foxconn is reportedly developing internal large language models to optimize factory management.

Macroeconomic Environment

- Inflation Hedging Properties: Measures to curb price wars and overcapacity are believed to help alleviate deflation and improve corporate profitability.

Technological Development and Ecosystem Building

-

Industry-Specific Models: Companies are training specialized or customized large language models for different industries, creating differentiated business models. For instance, BloombergGPT is a 50 billion parameter model specifically trained for financial language, outperforming general models in financial Q&A tasks.

-

Ecosystem Applications: Huawei's Pangu mining model has been applied to multiple mines in China, using AI analysis to enhance mining safety and efficiency. The Pangu weather model can predict typhoon paths for the next 10 days in 10 seconds, which is several orders of magnitude faster than traditional numerical methods.

III. CATGPT Price Prediction for 2025-2030

2025 Outlook

- Conservative prediction: $0.00011 - $0.00013

- Neutral prediction: $0.00013 - $0.00015

- Optimistic prediction: $0.00015 - $0.00021 (requires positive market sentiment)

2026-2027 Outlook

- Market stage expectation: Potential growth phase

- Price range forecast:

- 2026: $0.00009 - $0.00024

- 2027: $0.00017 - $0.00026

- Key catalysts: Increasing adoption and technological advancements

2028-2030 Long-term Outlook

- Base scenario: $0.00023 - $0.00032 (assuming steady market growth)

- Optimistic scenario: $0.00029 - $0.00038 (assuming strong market performance)

- Transformative scenario: $0.00033 - $0.00038 (assuming breakthrough innovations)

- 2030-12-31: CATGPT $0.00032 (potential peak price)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.00021 | 0.00014 | 0.00011 | 0 |

| 2026 | 0.00024 | 0.00017 | 0.00009 | 24 |

| 2027 | 0.00026 | 0.00021 | 0.00017 | 46 |

| 2028 | 0.00029 | 0.00023 | 0.00019 | 65 |

| 2029 | 0.00038 | 0.00026 | 0.00024 | 85 |

| 2030 | 0.00033 | 0.00032 | 0.0003 | 127 |

IV. CATGPT Professional Investment Strategies and Risk Management

CATGPT Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Risk-tolerant investors with a long-term perspective

- Operation suggestions:

- Accumulate CATGPT tokens during market dips

- Set price targets for partial profit-taking

- Store tokens in a secure non-custodial wallet

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Use to identify trends and potential reversal points

- Relative Strength Index (RSI): Monitor overbought/oversold conditions

- Key points for swing trading:

- Set stop-loss orders to limit potential losses

- Take profits at predetermined resistance levels

CATGPT Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3%

- Aggressive investors: 5-10%

- Professional investors: 10-15%

(2) Risk Hedging Solutions

- Diversification: Spread investments across multiple cryptocurrencies

- Stop-loss orders: Implement to limit potential losses

(3) Secure Storage Solutions

- Hot wallet recommendation: Gate Web3 Wallet

- Cold storage solution: Hardware wallet for long-term holdings

- Security precautions: Enable two-factor authentication, use strong passwords

V. CATGPT Potential Risks and Challenges

CATGPT Market Risks

- High volatility: Meme tokens are known for extreme price fluctuations

- Limited liquidity: May face challenges in executing large trades

- Market sentiment: Susceptible to rapid shifts in investor mood

CATGPT Regulatory Risks

- Uncertain regulatory environment: Potential for stricter regulations on meme tokens

- Compliance issues: May face challenges in meeting evolving regulatory requirements

- Legal status: Risk of being classified as a security in some jurisdictions

CATGPT Technical Risks

- Smart contract vulnerabilities: Potential for exploits or bugs in the token contract

- Solana network congestion: May impact transaction speed and costs

- wallet compatibility: Limited support across various cryptocurrency wallets

VI. Conclusion and Action Recommendations

CATGPT Investment Value Assessment

CATGPT presents a high-risk, high-reward investment opportunity. While it offers potential for significant gains due to its meme status and community support, it also carries substantial risks related to market volatility, regulatory uncertainty, and technical challenges.

CATGPT Investment Recommendations

✅ Beginners: Limit exposure to a small percentage of portfolio, focus on education

✅ Experienced investors: Consider as part of a diversified crypto portfolio, implement strict risk management

✅ Institutional investors: Approach with caution, conduct thorough due diligence before any significant allocation

CATGPT Trading Participation Methods

- Spot trading: Buy and sell CATGPT tokens on Gate.com

- Dollar-cost averaging: Regularly purchase small amounts to reduce impact of volatility

- Staking: Explore potential staking opportunities if available on supported platforms

Cryptocurrency investment carries extremely high risk, and this article does not constitute investment advice. Investors should make decisions carefully based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

Can ChatGPT predict stock prices?

No, ChatGPT can't reliably predict stock prices. It lacks real-time data and market understanding needed for accurate forecasts.

Which AI coin will boom in 2025?

Bittensor (TAO) is expected to boom in 2025. Regulatory clarity and institutional demand support its growth. The market cap is projected to reach $24-27 billion.

Will Fetch AI reach $100?

Yes, Fetch AI could potentially reach $100. While speculative, its innovative AI technology and growing adoption in the crypto space make it a strong contender for significant price growth.

Can XRP hit $20 in 2025?

While possible, it's unlikely. Current projections suggest XRP could reach $10 to $15 by 2025, depending on regulatory approvals and adoption rates. However, cryptocurrency markets are highly volatile and unpredictable.

Share

Content