2025 GOAL Price Prediction: Analyzing Market Trends and Potential Growth Factors for the Digital Asset

Introduction: GOAL's Market Position and Investment Value

TopGoal (GOAL), as a football metaverse driven by officially authorized digital collectibles and web3 football games, has made significant strides since its inception in 2023. As of 2025, GOAL's market capitalization has reached $704,632.5, with a circulating supply of approximately 536,250,000 tokens, and a price hovering around $0.001314. This asset, often referred to as the "Sports SocialFi Pioneer," is playing an increasingly crucial role in connecting sports with Web3 technology.

This article will comprehensively analyze GOAL's price trends from 2025 to 2030, taking into account historical patterns, market supply and demand, ecosystem development, and macroeconomic factors, to provide investors with professional price predictions and practical investment strategies.

I. GOAL Price History Review and Current Market Status

GOAL Historical Price Evolution

- 2023: Project launch, price reached all-time high of $1.2392 on February 27

- 2024: Market downturn, price experienced significant decline

- 2025: Continued bearish trend, price hit all-time low of $0.000999 on October 20

GOAL Current Market Situation

As of October 30, 2025, GOAL is trading at $0.001314, with a 24-hour trading volume of $26,417.08. The token has experienced a 1.79% decrease in the last 24 hours. GOAL's market cap currently stands at $704,632.5, ranking it at #3146 in the cryptocurrency market. The circulating supply is 536,250,000 GOAL tokens, representing 53.625% of the total supply of 1,000,000,000 GOAL.

GOAL has shown mixed performance across different timeframes. While it has seen a slight increase of 0.08% in the past hour, it has experienced significant losses over longer periods. The token has gained 10.39% in the past week, but has fallen by 43.5% over the last 30 days and a staggering 93.67% over the past year.

The current price of $0.001314 is significantly lower than its all-time high of $1.2392, representing a 99.89% decrease from its peak. This indicates that GOAL has faced substantial challenges in maintaining its value in the current market conditions.

Click to view the current GOAL market price

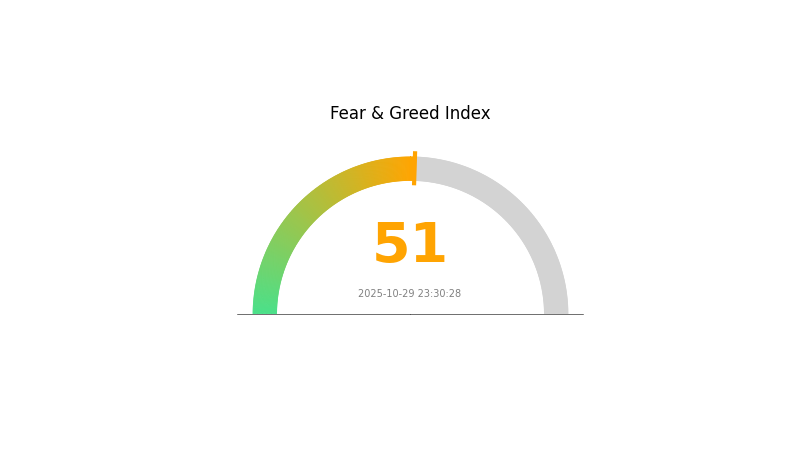

GOAL Market Sentiment Indicator

2025-10-29 Fear and Greed Index: 51 (Neutral)

Click to view the current Fear & Greed Index

The crypto market sentiment is currently in a neutral state, with the Fear and Greed Index registering at 51. This balanced outlook suggests that investors are neither overly fearful nor excessively greedy. Such equilibrium often indicates a period of stability in the market, where both buying and selling pressures are relatively equal. Traders and investors should remain vigilant, as neutral sentiment can sometimes precede significant market movements in either direction. As always, it's crucial to conduct thorough research and manage risk appropriately when making investment decisions.

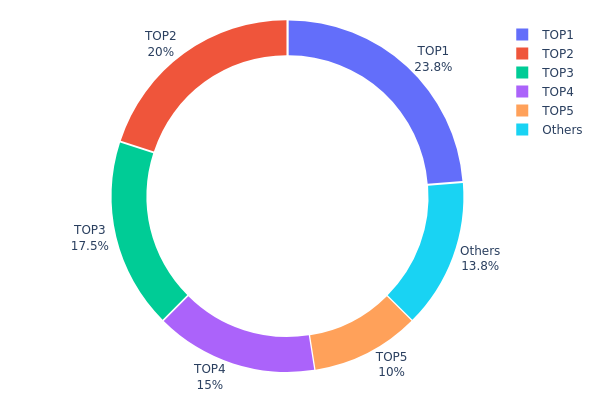

GOAL Holdings Distribution

The address holdings distribution for GOAL reveals a highly concentrated ownership structure. The top 5 addresses collectively control 86.25% of the total supply, with the largest holder possessing 23.75%. This level of concentration raises concerns about potential market manipulation and price volatility.

Such a centralized distribution could lead to significant price swings if any of the major holders decide to sell their positions. It also suggests a low level of decentralization, which may impact the project's long-term stability and governance. The remaining 13.75% distributed among other addresses indicates limited retail participation and could result in reduced liquidity in the secondary market.

This concentration of holdings may pose risks to GOAL's market structure and could potentially deter new investors concerned about whale dominance. It's crucial for the project to work towards a more balanced distribution to enhance market resilience and foster broader adoption.

Click to view the current GOAL holdings distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x0955...7880c5 | 237500.00K | 23.75% |

| 2 | 0x4622...86bbab | 200000.00K | 20.00% |

| 3 | 0x696e...cb3a6a | 175000.00K | 17.50% |

| 4 | 0x087b...bfe226 | 150000.00K | 15.00% |

| 5 | 0xf37a...728a8e | 100000.00K | 10.00% |

| - | Others | 137500.00K | 13.75% |

II. Key Factors Affecting GOAL's Future Price

Supply Mechanism

- Central Bank Purchases: Central banks have been consistently buying gold, with annual net purchases exceeding 1000 tons since 2022. This trend is expected to continue, providing stable demand for gold.

- Historical Pattern: Central bank gold purchases have historically supported gold prices during periods of economic uncertainty.

- Current Impact: The ongoing central bank purchases are expected to maintain upward pressure on gold prices, with 2025 purchases projected to reach 900 tons.

Institutional and Whale Movements

- Institutional Holdings: ETF holdings have become a significant source of gold demand. In the first half of 2025, gold ETF inflows reached 397 tons, the highest level for the period since 2020.

- Corporate Adoption: Not specifically mentioned in the provided context.

- National Policies: There's a global trend towards "de-dollarization", with 95% of central banks planning to increase gold holdings in the coming year.

Macroeconomic Environment

- Monetary Policy Impact: The Federal Reserve's dovish stance and potential rate cuts in 2025 are supporting gold prices. Other major central banks are also adopting accommodative policies.

- Inflation Hedging Properties: Gold continues to be viewed as an inflation hedge, although its correlation with real interest rates has weakened in recent years.

- Geopolitical Factors: Ongoing geopolitical tensions and uncertainties in emerging markets are driving safe-haven demand for gold.

Technical Developments and Ecosystem Building

- Market Infrastructure: Technological innovations and improvements in market infrastructure may enhance the efficiency of the gold market, potentially affecting price dynamics.

- Ecosystem Applications: The growth of gold-backed ETFs and other financial derivatives is expanding the gold ecosystem and influencing price movements.

III. GOAL Price Prediction for 2025-2030

2025 Outlook

- Conservative prediction: $0.00099 - $0.00115

- Neutral prediction: $0.00115 - $0.00145

- Optimistic prediction: $0.00145 - $0.0017 (requires sustained market growth and project development)

2027-2028 Outlook

- Market stage expectation: Potential consolidation followed by growth phase

- Price range forecast:

- 2027: $0.00088 - $0.00202

- 2028: $0.00104 - $0.00237

- Key catalysts: Project milestones, market sentiment, and overall crypto adoption

2030 Long-term Outlook

- Base scenario: $0.00208 - $0.00304 (assuming steady market growth)

- Optimistic scenario: $0.00304 - $0.00351 (assuming strong project performance and favorable market conditions)

- Transformative scenario: $0.00351+ (exceptional project breakthroughs and widespread adoption)

- 2030-12-31: GOAL $0.00256 (94% increase from 2025)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.0017 | 0.00132 | 0.00099 | 0 |

| 2026 | 0.00164 | 0.00151 | 0.00136 | 14 |

| 2027 | 0.00202 | 0.00157 | 0.00088 | 19 |

| 2028 | 0.00237 | 0.0018 | 0.00104 | 36 |

| 2029 | 0.00304 | 0.00208 | 0.00148 | 58 |

| 2030 | 0.00351 | 0.00256 | 0.00151 | 94 |

IV. Professional Investment Strategies and Risk Management for GOAL

GOAL Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Long-term investors and football enthusiasts

- Operation suggestions:

- Accumulate GOAL tokens during market dips

- Stay updated on TopGoal's project developments and partnerships

- Store tokens in a secure non-custodial wallet

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Use to identify trends and potential entry/exit points

- Relative Strength Index (RSI): Monitor overbought/oversold conditions

- Key points for swing trading:

- Monitor football-related news and events that may impact GOAL's price

- Set stop-loss orders to manage downside risk

GOAL Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3% of crypto portfolio

- Aggressive investors: 5-10% of crypto portfolio

- Professional investors: Up to 15% of crypto portfolio

(2) Risk Hedging Solutions

- Diversification: Spread investments across multiple crypto assets

- Stop-loss orders: Implement to limit potential losses

(3) Secure Storage Solutions

- Hot wallet recommendation: Gate Web3 Wallet

- Cold storage solution: Hardware wallet for long-term holding

- Security precautions: Enable two-factor authentication, use strong passwords

V. Potential Risks and Challenges for GOAL

GOAL Market Risks

- Volatility: Cryptocurrency markets are highly volatile

- Competition: Other sports-related crypto projects may emerge

- Adoption: Slow user adoption of the TopGoal ecosystem

GOAL Regulatory Risks

- Uncertain regulations: Cryptocurrency regulations may impact GOAL's operations

- Cross-border restrictions: International regulations may limit global participation

- NFT regulations: Potential changes in NFT regulations could affect TopGoal's offerings

GOAL Technical Risks

- Smart contract vulnerabilities: Potential security issues in the token's smart contract

- Scalability challenges: The platform may face issues handling increased user activity

- Interoperability: Challenges in integrating with other blockchain networks or platforms

VI. Conclusion and Action Recommendations

GOAL Investment Value Assessment

GOAL presents a unique opportunity in the sports and crypto intersection, with potential long-term value tied to the growth of the TopGoal ecosystem. However, short-term risks include market volatility and regulatory uncertainties.

GOAL Investment Recommendations

✅ Beginners: Start with small investments, focus on learning about the project ✅ Experienced investors: Consider a moderate allocation based on risk tolerance ✅ Institutional investors: Conduct thorough due diligence and consider long-term potential

GOAL Trading Participation Methods

- Spot trading: Buy and sell GOAL tokens on Gate.com

- Staking: Participate in staking programs if offered by TopGoal

- NFT trading: Engage with TopGoal's NFT offerings on their platform

Cryptocurrency investments carry extremely high risks, and this article does not constitute investment advice. Investors should make decisions based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

Will gold go to $4000 an ounce?

Yes, gold is expected to surpass $4000 an ounce. Analysts predict the average price will reach $4,275 in 2026, a significant increase from previous forecasts.

Will gold be higher in 2025?

Yes, gold prices are expected to be higher in 2025. Forecasts suggest gold could reach $3,675 per ounce by the end of 2025, driven by strong demand from central banks and investors.

Will gold reach $5000 an ounce?

Yes, gold could reach $5000 an ounce soon. Experts predict it may hit this price within a year and potentially double to $10,000 by 2030, driven by current market trends.

Will gold reach $10,000 an ounce?

While unlikely in the near term, gold could reach $10,000 an ounce under exceptional economic conditions. Current trends don't suggest this soon, but it remains a possibility in the long run.

Share

Content