2025 ISLAND Price Prediction: Navigating the Future of Crypto's Paradise Oasis

Introduction: ISLAND's Market Position and Investment Value

Nifty Island (ISLAND), as an open gaming platform powered by user-generated content, has achieved significant milestones since its inception. As of 2025, ISLAND's market capitalization has reached $1,209,755, with a circulating supply of approximately 140,050,434 tokens, and a price hovering around $0.008638. This asset, known as a "web3 gaming creator economy," is playing an increasingly crucial role in the field of blockchain-based gaming and digital collectibles.

This article will comprehensively analyze ISLAND's price trends from 2025 to 2030, considering historical patterns, market supply and demand, ecosystem development, and macroeconomic factors to provide investors with professional price predictions and practical investment strategies.

I. ISLAND Price History Review and Current Market Status

ISLAND Historical Price Evolution

- 2024: Project launch, price peaked at $0.675 on December 17

- 2025: Market downturn, price dropped to an all-time low of $0.00792 on October 11

ISLAND Current Market Situation

As of October 29, 2025, ISLAND is trading at $0.008638, representing a 98.72% decrease from its all-time high. The token's market capitalization stands at $1,209,755.65, ranking 2690th in the cryptocurrency market. Over the past 24 hours, ISLAND has experienced a 1.86% decrease in price, with a trading volume of $23,240.71. The circulating supply is 140,050,434.10 ISLAND tokens, which accounts for 14.01% of the total supply of 1,000,000,000 ISLAND.

Click to view the current ISLAND market price

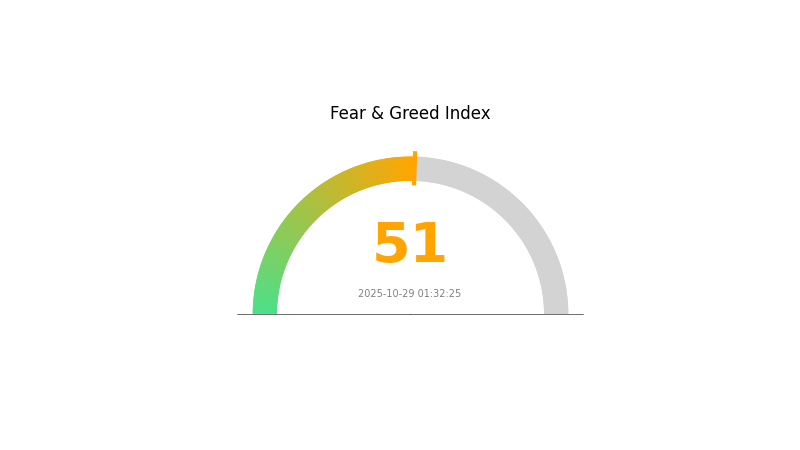

ISLAND Market Sentiment Indicator

2025-10-29 Fear and Greed Index: 51 (Neutral)

Click to view the current Fear & Greed Index

The crypto market sentiment remains neutral today, with the Fear and Greed Index at 51. This balanced sentiment suggests investors are neither overly optimistic nor pessimistic. While the market shows stability, traders should remain vigilant and make informed decisions. Remember to diversify your portfolio and use tools like Gate.com's ISLAND to stay updated on market trends. As always, conduct thorough research before making any investment choices in the volatile crypto space.

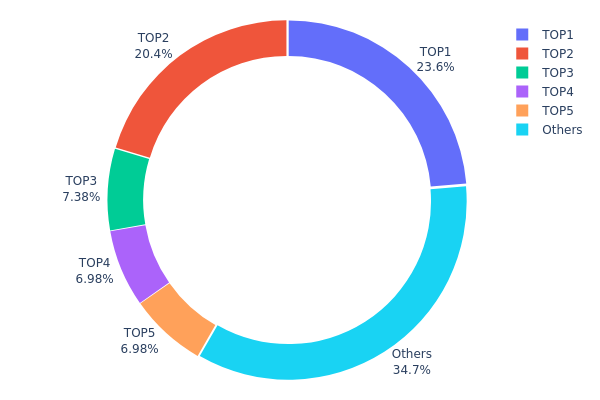

ISLAND Holdings Distribution

The address holdings distribution data for ISLAND reveals a highly concentrated ownership structure. The top 5 addresses collectively control 65.32% of the total supply, with the largest holder possessing 23.63% of all tokens. This level of concentration raises concerns about potential market manipulation and price volatility.

The second-largest holder owns 20.36% of the supply, further exacerbating the centralization issue. With the top two addresses controlling nearly 44% of all tokens, there is a significant risk of coordinated actions affecting market dynamics. The remaining top 5 addresses each hold between 6.98% and 7.37%, contributing to a top-heavy distribution that may impede true decentralization and market efficiency.

This concentration of ISLAND tokens in a few hands could lead to increased price volatility and susceptibility to large-scale dumps or manipulative trading patterns. It also suggests that the project's governance and decision-making processes may be disproportionately influenced by a small number of stakeholders, potentially compromising the broader community's interests.

Click to view the current ISLAND Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0xa096...d98120 | 220000.00K | 23.63% |

| 2 | 0x0d15...383eb9 | 189584.51K | 20.36% |

| 3 | 0x903b...3d9242 | 68651.77K | 7.37% |

| 4 | 0xc4b3...699e65 | 65000.00K | 6.98% |

| 5 | 0xd8cd...97937b | 65000.00K | 6.98% |

| - | Others | 322527.03K | 34.68% |

II. Key Factors Affecting ISLAND's Future Price

Supply Mechanism

- Monetary Devaluation Trade: This strategy views gold as a hedge against dollar risk, based on the logic that the dollar's value will face devaluation pressure.

- Historical Pattern: In the past, increased liquidity chasing limited assets has driven up gold prices.

- Current Impact: The recent sharp drop in gold prices is seen as a conditioned reflex after a period of sharp rises, rather than a long-term trend.

Institutional and Whale Dynamics

- Corporate Adoption: Japan's three major banks - Mitsubishi UFJ Financial Group, Sumitomo Mitsui, and Mizuho - plan to jointly launch their own yen stablecoin on October 31, 2025, through Mitsubishi UFJ's Progmat platform.

Macroeconomic Environment

- Monetary Policy Impact: Expectations of continued loose global liquidity conditions are likely to support gold prices in the coming years.

- Inflation Hedging Properties: Gold is viewed as a hedge against currency devaluation and inflation risks.

- Geopolitical Factors: Ongoing geopolitical tensions and conflicts are contributing to gold's appeal as a safe-haven asset.

Technological Development and Ecosystem Building

- AI and Quantum Computing: Advancements in artificial intelligence and quantum communication are driving innovation and economic growth in China.

- Digital Economy: China's digital economy is thriving, with the added value of scale-above digital product manufacturing increasing by 9.7% year-on-year in the first three quarters of 2025.

- Ecosystem Applications: Emerging consumption models like instant retail, live-streaming e-commerce, and social e-commerce are experiencing rapid growth, with online retail sales increasing by 9.8% year-on-year in the first three quarters of 2025.

III. ISLAND Price Prediction for 2025-2030

2025 Outlook

- Conservative prediction: $0.00527 - $0.00864

- Neutral prediction: $0.00864 - $0.01037

- Optimistic prediction: $0.01037 - $0.01169 (requires strong market sentiment and increased adoption)

2027-2028 Outlook

- Market stage expectation: Potential growth phase with increasing adoption

- Price range forecast:

- 2027: $0.0071 - $0.0141

- 2028: $0.01049 - $0.01815

- Key catalysts: Technological advancements, expanded use cases, and overall crypto market growth

2029-2030 Long-term Outlook

- Base scenario: $0.01525 - $0.01677 (assuming steady market growth and adoption)

- Optimistic scenario: $0.01830 - $0.02432 (assuming accelerated adoption and favorable market conditions)

- Transformative scenario: $0.02432+ (assuming breakthrough applications and mainstream integration)

- 2030-12-31: ISLAND $0.02432 (potential peak price based on optimistic projections)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.01037 | 0.00864 | 0.00527 | 0 |

| 2026 | 0.01169 | 0.00951 | 0.00827 | 10 |

| 2027 | 0.0141 | 0.0106 | 0.0071 | 22 |

| 2028 | 0.01815 | 0.01235 | 0.01049 | 42 |

| 2029 | 0.0183 | 0.01525 | 0.01449 | 76 |

| 2030 | 0.02432 | 0.01677 | 0.01191 | 94 |

IV. ISLAND Professional Investment Strategies and Risk Management

ISLAND Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Long-term investors and believers in the Nifty Island ecosystem

- Operational advice:

- Accumulate ISLAND tokens during market dips

- Participate actively in the Nifty Island platform to understand its growth

- Store tokens securely in a non-custodial wallet

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Use to identify trends and potential entry/exit points

- Relative Strength Index (RSI): Identify overbought or oversold conditions

- Key points for swing trading:

- Monitor platform adoption metrics and user growth

- Stay informed about new features and partnerships

ISLAND Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3% of crypto portfolio

- Aggressive investors: 5-10% of crypto portfolio

- Professional investors: Up to 15% of crypto portfolio

(2) Risk Hedging Solutions

- Diversification: Spread investments across different gaming and metaverse tokens

- Stop-loss orders: Implement to limit potential losses

(3) Secure Storage Solutions

- Hot wallet recommendation: Gate Web3 Wallet

- Cold storage solution: Hardware wallet for long-term holdings

- Security precautions: Use two-factor authentication, avoid sharing private keys

V. Potential Risks and Challenges for ISLAND

ISLAND Market Risks

- High volatility: Gaming tokens can experience significant price swings

- Competition: Emerging gaming platforms may impact Nifty Island's market share

- Market sentiment: Overall crypto market trends can affect ISLAND's performance

ISLAND Regulatory Risks

- Unclear regulations: Gaming tokens may face regulatory scrutiny

- Compliance issues: Potential challenges in adapting to new regulatory requirements

- Cross-border restrictions: Varying regulations across jurisdictions may limit adoption

ISLAND Technical Risks

- Platform vulnerabilities: Potential security breaches or smart contract flaws

- Scalability challenges: Possible limitations in handling increased user activity

- Technological obsolescence: Rapid advancements in gaming technology may require constant updates

VI. Conclusion and Action Recommendations

ISLAND Investment Value Assessment

ISLAND presents a unique opportunity in the gaming and metaverse sector, with strong potential for long-term growth. However, investors should be aware of the high volatility and regulatory uncertainties in the short term.

ISLAND Investment Recommendations

✅ Beginners: Start with small, regular investments to learn about the platform ✅ Experienced investors: Consider a balanced approach, mixing long-term holding with strategic trading ✅ Institutional investors: Conduct thorough due diligence and consider ISLAND as part of a diversified gaming and metaverse portfolio

ISLAND Trading Participation Methods

- Spot trading: Buy and sell ISLAND tokens on Gate.com

- Staking: Participate in staking programs if available on the Nifty Island platform

- In-game participation: Engage with the Nifty Island ecosystem to potentially earn rewards

Cryptocurrency investments carry extremely high risks, and this article does not constitute investment advice. Investors should make decisions carefully based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

Does injective crypto have a future?

Yes, Injective crypto has a promising future. As a leading DeFi token with institutional-grade infrastructure, it's poised for significant growth and adoption in the coming years.

How much is the island token worth?

As of October 29, 2025, the ISLAND token is worth $0.008686. This price represents a 1.1% change from the previous day's value.

What will Shiba Inu be worth in 2025?

Shiba Inu's price in 2025 is projected to reach $0.000025, based on current market trends and analysis. This indicates significant growth potential for SHIB.

Will 1inch reach $10?

1inch is projected to reach $10 by 2028, based on current market trends and analysis. This forecast remains plausible as of 2025.

Share

Content