2025 MOONPIG Price Prediction: Navigating Growth Potential and Market Trends in the Personalized Greeting Card Industry

Introduction: MOONPIG's Market Position and Investment Value

Moonpig (MOONPIG), as a satirical meme coin born from internet culture, has been thriving purely on community energy and viral memes since its inception. As of 2025, MOONPIG's market capitalization has reached $978,003, with a circulating supply of approximately 980,356,248 tokens, and a price hovering around $0.0009976. This asset, dubbed as "a cult-like phenomenon," is playing an increasingly significant role in the meme coin and community-driven crypto space.

This article will provide a comprehensive analysis of MOONPIG's price trends from 2025 to 2030, combining historical patterns, market supply and demand, ecosystem development, and macroeconomic factors to offer professional price predictions and practical investment strategies for investors.

I. MOONPIG Price History Review and Current Market Status

MOONPIG Historical Price Evolution

- 2025 June: MOONPIG reached its all-time high of $0.04

- 2025 October: MOONPIG hit its all-time low of $0.0008474

MOONPIG Current Market Situation

MOONPIG is currently trading at $0.0009976, with a 24-hour trading volume of $26,037.50. The token has experienced a 3.56% decrease in the last 24 hours. Its market capitalization stands at $978,003.39, ranking it at 2883 in the overall cryptocurrency market. The circulating supply is 980,356,248 MOONPIG tokens, which is 98.04% of the maximum supply of 1,000,000,000 tokens. Despite the recent dip, MOONPIG has shown significant growth over the past year, with a 1461.47% increase in price.

Click to view the current MOONPIG market price

MOONPIG Market Sentiment Indicator

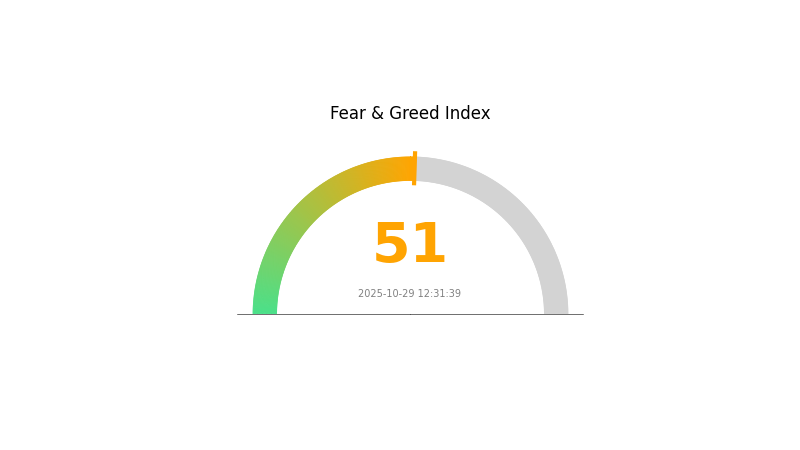

2025-10-29 Fear and Greed Index: 51 (Neutral)

Click to view the current Fear & Greed Index

The cryptocurrency market sentiment remains balanced today, with the Fear and Greed Index at 51, indicating a neutral stance. This suggests that investors are neither overly optimistic nor pessimistic about the current market conditions. While caution is still advisable, the neutral sentiment could present opportunities for strategic trading. As always, it's crucial to conduct thorough research and consider your risk tolerance before making any investment decisions in the volatile crypto market.

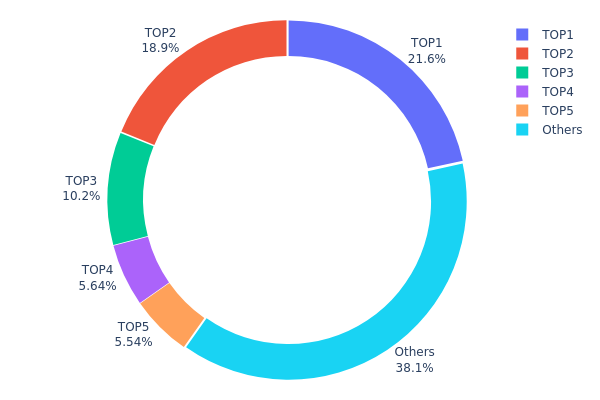

MOONPIG Holdings Distribution

The address holdings distribution data for MOONPIG reveals a significant concentration of tokens among the top holders. The top 5 addresses collectively control 61.84% of the total supply, with the largest holder possessing 21.59% of all tokens. This high level of concentration raises concerns about potential market manipulation and volatility.

The distribution pattern suggests a relatively centralized token structure, which may impact market dynamics. With over 60% of tokens held by just five addresses, there's a risk of large sell-offs or coordinated actions affecting price stability. Furthermore, this concentration could potentially undermine the project's decentralization ethos and governance mechanisms.

While 38.16% of tokens are distributed among other addresses, the current holding pattern indicates a need for broader distribution to enhance market resilience and reduce manipulation risks. This concentration level may deter some investors concerned about fair market conditions and long-term stability of the MOONPIG ecosystem.

Click to view the current MOONPIG Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 4QXXp1...zGaYB3 | 211670.12K | 21.59% |

| 2 | F8R9ok...eRUYJw | 184995.91K | 18.87% |

| 3 | 5FsTZQ...jzPaeg | 100000.00K | 10.20% |

| 4 | u6PJ8D...ynXq2w | 55308.11K | 5.64% |

| 5 | ASTyfS...g7iaJZ | 54349.80K | 5.54% |

| - | Others | 373972.16K | 38.16% |

II. Key Factors Influencing MOONPIG's Future Price

Market Dynamics

- Market Manipulation: Large traders can significantly impact MOONPIG's price. For instance, on May 22, MOONPIG's market cap surged from $30 million to $100 million, a 3x increase, driven by James Wynn's public trading calls.

- Historical Pattern: Sudden price spikes followed by sharp declines have been observed, with a 30% drop occurring shortly after a major rally.

- Current Impact: The cryptocurrency's price remains highly susceptible to manipulation by influential traders and large-scale transactions.

Liquidity and Trading Volume

- Liquidity Changes: Adding or removing liquidity from trading pools can significantly affect MOONPIG's price.

- Trading Volume: The level of trading activity in a given period directly impacts price volatility.

- Slippage: Larger liquidity pools generally result in lower price fluctuations and reduced slippage, while smaller pools lead to higher volatility.

Market Sentiment

- Trader Behavior: The actions of prominent traders, such as James Wynn, can sway market sentiment and trigger rapid price movements.

- Public Positions: On platforms like Hyperliquid, traders' public positions can influence market emotions and potentially lead to price manipulation.

Technical Factors

- Price Position: The current price level relative to historical highs and lows can indicate potential for further growth or correction.

- Technical Signals: Suspicious technical indicators, especially when the price is at a high point, may suggest increased sell pressure from major holders.

Overall Market Conditions

- Broader Crypto Market: The general trend of the cryptocurrency market significantly affects individual tokens like MOONPIG.

- Risk Assessment: MOONPIG is currently considered a high-risk asset, with potential for price rebounds but also substantial uncertainty.

III. MOONPIG Price Prediction for 2025-2030

2025 Outlook

- Conservative prediction: $0.00066 - $0.00088

- Neutral prediction: $0.00088 - $0.00122

- Optimistic prediction: $0.00122 - $0.00144 (requires positive market sentiment and project developments)

2027-2028 Outlook

- Market phase expectation: Potential growth phase with increased adoption

- Price range forecast:

- 2027: $0.00106 - $0.00147

- 2028: $0.00082 - $0.00156

- Key catalysts: Project upgrades, market recovery, and increased utility of MOONPIG

2029-2030 Long-term Outlook

- Base scenario: $0.00149 - $0.00160 (assuming steady market growth)

- Optimistic scenario: $0.00160 - $0.00175 (with strong project performance and market conditions)

- Transformative scenario: $0.00175 - $0.00191 (with breakthrough innovations and mass adoption)

- 2030-12-31: MOONPIG $0.00191 (potential peak based on optimistic projections)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.00144 | 0.001 | 0.00066 | 0 |

| 2026 | 0.00158 | 0.00122 | 0.00103 | 21 |

| 2027 | 0.00147 | 0.0014 | 0.00106 | 40 |

| 2028 | 0.00156 | 0.00143 | 0.00082 | 43 |

| 2029 | 0.0016 | 0.0015 | 0.00097 | 50 |

| 2030 | 0.00191 | 0.00155 | 0.00149 | 55 |

IV. MOONPIG Professional Investment Strategies and Risk Management

MOONPIG Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Risk-tolerant investors with a high appetite for volatility

- Operation suggestions:

- Accumulate MOONPIG tokens during market dips

- Hold for extended periods, ignoring short-term price fluctuations

- Store tokens in a secure non-custodial wallet

(2) Active Trading Strategy

- Technical analysis tools:

- Relative Strength Index (RSI): Use to identify overbought and oversold conditions

- Moving Averages: Track short-term and long-term trends

- Key points for swing trading:

- Monitor social media trends and meme popularity

- Set strict stop-loss orders to manage risk

MOONPIG Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-2% of crypto portfolio

- Aggressive investors: 5-10% of crypto portfolio

- Professional investors: Up to 15% of high-risk allocation

(2) Risk Hedging Solutions

- Diversification: Spread investments across multiple meme coins and traditional cryptocurrencies

- Stop-loss orders: Implement automated sell orders to limit potential losses

(3) Secure Storage Solutions

- Hot wallet recommendation: Gate Web3 Wallet

- Cold storage solution: Hardware wallet for long-term holdings

- Security precautions: Enable two-factor authentication, use strong passwords, and be wary of phishing attempts

V. MOONPIG Potential Risks and Challenges

MOONPIG Market Risks

- High volatility: Extreme price swings based on social sentiment

- Liquidity risk: Potential difficulty in selling large positions

- Market manipulation: Vulnerability to pump-and-dump schemes

MOONPIG Regulatory Risks

- Regulatory crackdown: Potential restrictions on meme coins by financial authorities

- Exchange delistings: Risk of removal from trading platforms due to regulatory pressure

- Tax implications: Uncertainty regarding future taxation of meme coin gains

MOONPIG Technical Risks

- Smart contract vulnerabilities: Potential for exploits in the token's code

- Network congestion: Transaction delays during high-demand periods

- wallet security: Risk of theft through compromised wallets or user error

VI. Conclusion and Action Recommendations

MOONPIG Investment Value Assessment

MOONPIG presents a high-risk, high-reward opportunity within the meme coin sector. While it offers potential for significant short-term gains, its long-term value proposition remains speculative and highly dependent on community engagement and market sentiment.

MOONPIG Investment Recommendations

✅ Beginners: Limit exposure to a small percentage of overall portfolio, focus on education

✅ Experienced investors: Consider short-term trading opportunities with strict risk management

✅ Institutional investors: Approach with caution, potentially as part of a diversified crypto portfolio

MOONPIG Trading Participation Methods

- Spot trading: Buy and sell MOONPIG tokens on Gate.com

- Limit orders: Set predetermined buy and sell prices to automate trading

- DCA strategy: Implement a dollar-cost averaging approach for long-term accumulation

Cryptocurrency investments carry extremely high risk, and this article does not constitute investment advice. Investors should make decisions carefully based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

Is moonpig a good stock to buy?

Yes, Moonpig appears to be a good stock to buy. It has a Strong Buy consensus rating from analysts and a favorable outlook for future growth.

Can pi coin reach $100?

While possible, it's unlikely Pi coin will reach $100 soon. Projections suggest potential for higher values if widely adopted, but $100 remains a very ambitious target.

Is moonpig a meme coin?

Yes, Moonpig is a meme coin on the Solana blockchain. It's known for its community-driven nature and fun branding.

Does the Lunc coin have a future?

LUNC's future is uncertain but possible. It depends on continued community development and new use cases. Current market trends remain volatile.

Share

Content