2025 MUSIC Price Prediction: Will This Blockchain-Based Music Platform Hit a High Note?

Introduction: MUSIC's Market Position and Investment Value

GALA Music (MUSIC), as a decentralized platform in the music industry, has been making waves since its inception. As of 2025, MUSIC's market capitalization has reached $950,487, with a circulating supply of approximately 158,151,081 tokens, and a price hovering around $0.00601. This asset, often referred to as the "blockchain music revolution," is playing an increasingly crucial role in reshaping the music distribution and monetization landscape.

This article will provide a comprehensive analysis of MUSIC's price trends from 2025 to 2030, combining historical patterns, market supply and demand, ecosystem development, and macroeconomic factors to offer professional price predictions and practical investment strategies for investors.

I. MUSIC Price History Review and Current Market Status

MUSIC Historical Price Evolution

- 2023: Initial launch, price peaked at $0.35 on December 8

- 2024: Market volatility, price fluctuated between $0.35 and $0.004018

- 2025: Bearish trend, price dropped to an all-time low of $0.004018 on October 28

MUSIC Current Market Situation

As of October 29, 2025, MUSIC is trading at $0.00601, experiencing a significant decline of 16.39% in the past 24 hours. The token's market capitalization stands at $950,487.99, ranking 2899th in the global cryptocurrency market. MUSIC has seen a substantial decrease in value over various timeframes, with a 38.2% drop in the last 7 days and a 51.73% decline over the past 30 days. The current price is 98.28% below its all-time high of $0.35, recorded on December 8, 2023. Trading volume in the last 24 hours amounts to $15,861.89, indicating moderate market activity. The circulating supply is 158,151,081.1971539 MUSIC tokens, with a maximum supply cap of 1,000,000,000 tokens.

Click to view the current MUSIC market price

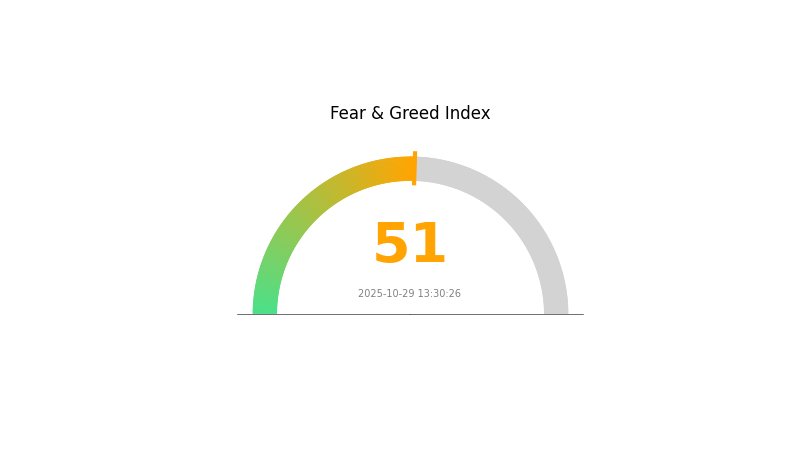

MUSIC Market Sentiment Indicator

2025-10-29 Fear and Greed Index: 51 (Neutral)

Click to view the current Fear & Greed Index

The cryptocurrency market sentiment remains balanced today, with the Fear and Greed Index standing at 51, indicating a neutral outlook. This suggests that investors are neither overly optimistic nor pessimistic about the current market conditions. Such a moderate sentiment often presents opportunities for thoughtful investment decisions, as the market is not swayed by extreme emotions. Traders and investors should continue to monitor market trends and conduct thorough research before making any financial moves in this balanced environment.

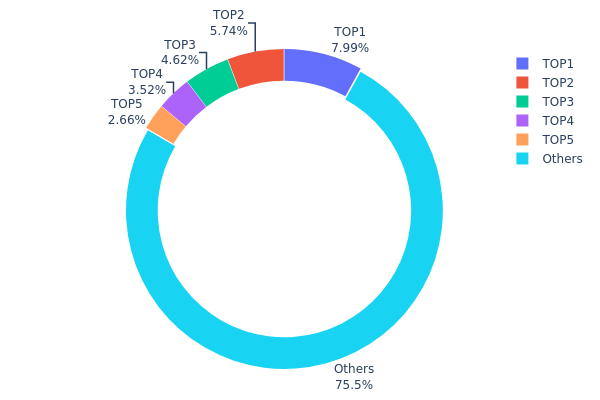

MUSIC Holdings Distribution

The address holdings distribution chart for MUSIC reveals a moderately concentrated ownership structure. The top 5 addresses collectively hold 24.5% of the total supply, with the largest holder possessing 7.98% of MUSIC tokens. This distribution indicates a relatively balanced ownership pattern, as no single address controls an overwhelming majority of the tokens.

While some concentration exists among the top holders, it's not excessive enough to raise immediate concerns about market manipulation. The fact that 75.5% of MUSIC tokens are distributed among numerous other addresses suggests a decent level of decentralization. This spread of ownership may contribute to market stability and reduce the risk of significant price volatility caused by large individual holders.

However, investors should note that the top 5 addresses still have the potential to influence market dynamics if they decide to make substantial moves. The current distribution reflects a market structure that balances between having influential stakeholders and maintaining a broad base of token holders, which could be seen as a positive sign for the project's on-chain governance and long-term stability.

Click to view the current MUSIC Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x5221...42a014 | 9842.50K | 7.98% |

| 2 | 0xd84f...68b709 | 7070.01K | 5.73% |

| 3 | 0x0d07...b492fe | 5689.02K | 4.61% |

| 4 | 0x1870...dda12e | 4343.57K | 3.52% |

| 5 | 0xef26...f05e04 | 3278.35K | 2.66% |

| - | Others | 93001.27K | 75.5% |

II. Key Factors Influencing the Future Price of MUSIC

Supply Mechanism

- Technological Innovation: Continuous advancements in technology drive the development of new production forces, potentially impacting MUSIC's supply and demand dynamics.

- Historical Pattern: Past technological breakthroughs have often led to increased adoption and value appreciation in related digital assets.

- Current Impact: The ongoing cultivation of new quality productive forces is expected to create new growth points and stimulate innovation, potentially boosting MUSIC's value proposition.

Institutional and Whale Dynamics

- Enterprise Adoption: Companies actively integrating "Internet+", "AI+", and "Digital+" technologies may increase demand for MUSIC tokens.

- National Policies: Government initiatives promoting high-quality development and new production forces could indirectly influence MUSIC's market position.

Macroeconomic Environment

- Monetary Policy Impact: Central banks' policies, particularly those aimed at economic stability and growth, may affect MUSIC's perceived value as an alternative investment.

- Geopolitical Factors: International tensions and trade disputes can impact global market sentiment, potentially influencing MUSIC's price as investors seek alternative assets.

Technical Development and Ecosystem Building

- AI Integration: The rapid development of artificial intelligence and its integration into various sectors could enhance MUSIC's utility and value.

- Digital Economy Growth: The booming digital economy, with increasing demand for computational power and digital products, may drive MUSIC's adoption and price.

- Green Transformation: The trend towards green and low-carbon development could create new opportunities for MUSIC if it aligns with sustainable practices.

- Ecosystem Applications: The growth of new consumption models like live-streaming e-commerce and social e-commerce could expand MUSIC's use cases and market reach.

III. MUSIC Price Prediction for 2025-2030

2025 Outlook

- Conservative forecast: $0.00317 - $0.00597

- Neutral forecast: $0.00597 - $0.00694

- Optimistic forecast: $0.00694 - $0.00794 (requires strong market momentum and positive industry developments)

2027-2028 Outlook

- Market phase expectation: Potential growth phase with increasing adoption

- Price range prediction:

- 2027: $0.00471 - $0.01047

- 2028: $0.00718 - $0.01131

- Key catalysts: Expanding use cases, technological advancements, and broader cryptocurrency market trends

2029-2030 Long-term Outlook

- Base scenario: $0.01014 - $0.01248 (assuming steady market growth and adoption)

- Optimistic scenario: $0.01248 - $0.01481 (with accelerated industry acceptance and favorable regulations)

- Transformative scenario: $0.01481 - $0.01700 (with breakthrough applications and mainstream integration)

- 2030-12-31: MUSIC $0.01323 (potential peak before year-end consolidation)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.00794 | 0.00597 | 0.00317 | 0 |

| 2026 | 0.008 | 0.00696 | 0.00404 | 15 |

| 2027 | 0.01047 | 0.00748 | 0.00471 | 24 |

| 2028 | 0.01131 | 0.00898 | 0.00718 | 49 |

| 2029 | 0.01481 | 0.01014 | 0.0072 | 68 |

| 2030 | 0.01323 | 0.01248 | 0.00736 | 107 |

IV. MUSIC Professional Investment Strategies and Risk Management

MUSIC Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Long-term investors and believers in the music industry's blockchain transformation

- Operation suggestions:

- Accumulate MUSIC tokens during market dips

- Stay informed about Gala Music platform developments

- Store tokens in secure hardware wallets

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Monitor short-term and long-term trends

- RSI (Relative Strength Index): Identify overbought and oversold conditions

- Key points for swing trading:

- Set strict stop-loss orders to manage risk

- Monitor volume trends for potential breakouts

MUSIC Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3% of crypto portfolio

- Aggressive investors: 5-10% of crypto portfolio

- Professional investors: Up to 15% of crypto portfolio

(2) Risk Hedging Solutions

- Diversification: Spread investments across multiple music-related tokens

- Stop-loss orders: Implement automatic sell orders to limit potential losses

(3) Secure Storage Solutions

- Hot wallet recommendation: Gate Web3 Wallet

- Cold storage solution: Hardware wallets for long-term holdings

- Security precautions: Enable two-factor authentication, use strong passwords

V. Potential Risks and Challenges for MUSIC

MUSIC Market Risks

- High volatility: Price fluctuations can be extreme

- Limited adoption: Dependence on Gala Music platform success

- Competition: Other blockchain music projects may gain market share

MUSIC Regulatory Risks

- Uncertain regulations: Potential changes in crypto regulations globally

- Copyright issues: Possible legal challenges related to music rights

- Tax implications: Evolving tax laws for crypto assets

MUSIC Technical Risks

- Smart contract vulnerabilities: Potential for exploits or bugs

- Scalability challenges: May face issues with increased user adoption

- Dependency on Ethereum: Subject to Ethereum network congestion and fees

VI. Conclusion and Action Recommendations

MUSIC Investment Value Assessment

MUSIC offers potential long-term value in the blockchain-based music industry but faces short-term volatility and adoption challenges. The token's success is closely tied to the Gala Music platform's growth and user adoption.

MUSIC Investment Recommendations

✅ Beginners: Start with small positions, focus on learning about the platform ✅ Experienced investors: Consider allocating a portion of high-risk portfolio, monitor closely ✅ Institutional investors: Conduct thorough due diligence, consider as part of a diversified crypto portfolio

MUSIC Participation Methods

- Buy and hold: Accumulate tokens for long-term investment

- Active trading: Engage in short-term trades based on technical analysis

- Platform participation: Use MUSIC tokens within the Gala Music ecosystem

Cryptocurrency investments carry extremely high risks, and this article does not constitute investment advice. Investors should make decisions carefully based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

What is the future of Audius?

Audius' future is driven by its token-based governance, where $AUDIO holders shape platform decisions. It aims to enhance artist-fan interactions through decentralized networks, focusing on community-driven initiatives and innovative features like gated content and artist tokens.

What is the price prediction for AMP in 2025?

Based on market analysis, AMP's price in 2025 is predicted to reach a maximum of $0.0125 and a minimum of $0.00783.

What is the stock price prediction for Tencent Music?

The stock price for Tencent Music is predicted to trade between $22.21 and $26.13, based on current trends as of 2025-10-29.

What is Music by Virtuals?

Music by Virtuals is a Web3 DJ AI Agent that blends human and AI requests to create music on the blockchain.

Share

Content