2025 ORO Price Prediction: Analyzing Market Trends and Potential Growth Factors

Introduction: ORO's Market Position and Investment Value

Operon Origins (ORO), as a GameFi NFT collectible card game, has made significant strides since its inception. As of 2025, Operon Origins has a market capitalization of $508,780, with a circulating supply of 100,000,000 tokens, and a price hovering around $0.0050878. This asset, dubbed as "the innovator in digital collectible card games," is playing an increasingly crucial role in the intersection of traditional gaming and blockchain technology.

This article will comprehensively analyze Operon Origins' price trends from 2025 to 2030, considering historical patterns, market supply and demand, ecosystem development, and macroeconomic factors, to provide investors with professional price predictions and practical investment strategies.

I. ORO Price History Review and Current Market Status

ORO Historical Price Evolution Trajectory

- 2021: All-time high reached, price peaked at $1.82 on December 3rd

- 2025: Market cycle low, price dropped to $0.00030568 on July 13th

- 2025: Recent recovery, price rebounded to $0.0050878 as of October 30th

ORO Current Market Situation

As of October 30, 2025, ORO is trading at $0.0050878, ranking 3437th in the cryptocurrency market. The token has experienced significant volatility over the past year, with a 658.24% increase in value. However, recent short-term performance shows mixed results. In the last 24 hours, ORO has seen a 14.39% decline, while the 7-day performance indicates a 13.54% decrease. On a more positive note, the 30-day trend shows a substantial 43.39% gain.

The current market capitalization of ORO stands at $508,780, with a circulating supply of 100,000,000 tokens, which is also the total and maximum supply. The 24-hour trading volume is reported at $99,476.56, suggesting moderate liquidity for the token.

ORO's all-time high of $1.82 was achieved on December 3, 2021, while its all-time low of $0.00030568 was recorded on July 13, 2025. The current price represents a significant recovery from the all-time low but remains well below the peak price.

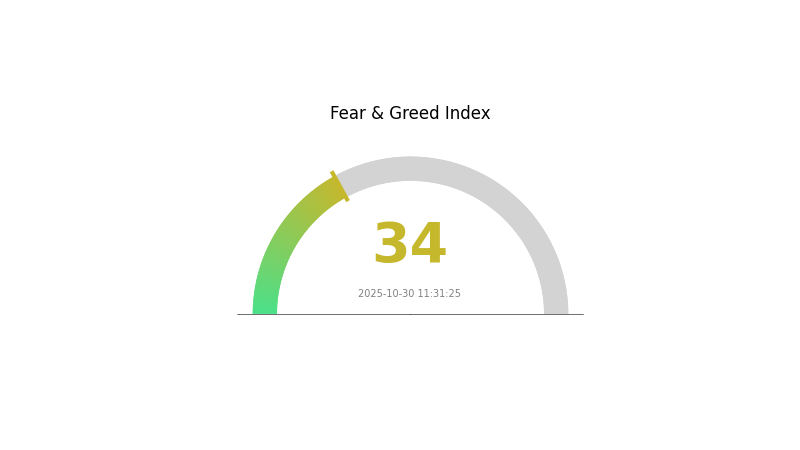

The market sentiment for cryptocurrencies overall is cautious, with the Fear and Greed Index indicating a "Fear" level at 34, which may be influencing ORO's recent price movements.

Click to view the current ORO market price

ORO Market Sentiment Indicator

2025-10-30 Fear and Greed Index: 34 (Fear)

Click to view the current Fear & Greed Index

The crypto market is currently gripped by fear, with the sentiment index at 34. This indicates a cautious mood among investors, potentially presenting buying opportunities for those willing to go against the crowd. However, it's crucial to remember that market sentiment can shift rapidly. Traders should exercise caution, conduct thorough research, and consider diversifying their portfolios. As always, it's wise to only invest what you can afford to lose in the volatile crypto space.

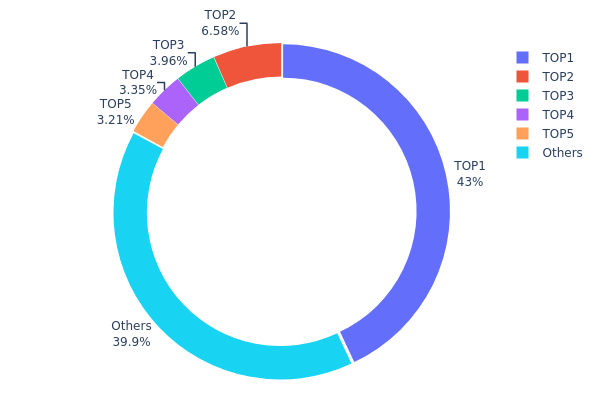

ORO Holdings Distribution

The address holdings distribution data reveals a significant concentration of ORO tokens. The top address holds 42.98% of the total supply, indicating a highly centralized ownership structure. The subsequent four largest holders account for an additional 17.08% of the tokens. This concentration raises concerns about potential market manipulation and volatility.

The dominance of a single address holding nearly half of the total supply suggests a lack of widespread distribution among users. This centralization could lead to increased price volatility if large transactions occur. Furthermore, it may impact the token's liquidity and overall market stability. The current distribution pattern also implies that ORO's on-chain structure and decentralization level are relatively weak, which could be a point of concern for potential investors and users of the ORO ecosystem.

Click to view the current ORO holdings distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x0d07...b492fe | 42988.03K | 42.98% |

| 2 | 0xc6bb...d5a18e | 6584.00K | 6.58% |

| 3 | 0x5b41...5c698f | 3961.46K | 3.96% |

| 4 | 0xe645...df0a93 | 3346.35K | 3.34% |

| 5 | 0xb85b...a08975 | 3207.75K | 3.20% |

| - | Others | 39912.41K | 39.94% |

II. Key Factors Influencing ORO's Future Price

Supply Mechanism

- Market Research Forecast: According to Dell'Oro report, the telecom server market is expected to achieve a compound annual growth rate of 19% over the next five years.

Macroeconomic Environment

- Inflation Hedging Properties: Even in wealthy countries, most consumers prioritize product price and quality, which may affect ORO's performance as a potential hedge against inflation.

Technological Development and Ecosystem Building

- Satellite Internet: The communication sector has shown a significant upward trend recently, with sub-sectors generally rising. This technological advancement in internet connectivity could potentially impact ORO's ecosystem and adoption.

III. ORO Price Prediction for 2025-2030

2025 Outlook

- Conservative prediction: $0.0029 - $0.00508

- Neutral prediction: $0.00508 - $0.00554

- Optimistic prediction: $0.00554 - $0.00599 (requires positive market sentiment)

2027-2028 Outlook

- Market phase expectation: Potential growth phase

- Price range forecast:

- 2027: $0.00518 - $0.00876

- 2028: $0.00637 - $0.01091

- Key catalysts: Increased adoption and technological advancements

2029-2030 Long-term Outlook

- Base scenario: $0.00925 - $0.01086 (assuming steady market growth)

- Optimistic scenario: $0.01086 - $0.01217 (assuming strong market performance)

- Transformative scenario: $0.01217 - $0.01248 (assuming exceptional market conditions)

- 2030-12-31: ORO $0.01217 (potential peak)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.00599 | 0.00508 | 0.0029 | 0 |

| 2026 | 0.00725 | 0.00554 | 0.00498 | 8 |

| 2027 | 0.00876 | 0.0064 | 0.00518 | 25 |

| 2028 | 0.01091 | 0.00758 | 0.00637 | 48 |

| 2029 | 0.01248 | 0.00925 | 0.00795 | 81 |

| 2030 | 0.01217 | 0.01086 | 0.00891 | 113 |

IV. Professional Investment Strategies and Risk Management for ORO

ORO Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Patient investors with a high-risk tolerance

- Operation suggestions:

- Accumulate ORO tokens during market dips

- Set price targets for partial profit-taking

- Store tokens in secure non-custodial wallets

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Use to identify trends and potential entry/exit points

- RSI (Relative Strength Index): Helps detect overbought/oversold conditions

- Key points for swing trading:

- Monitor game updates and user adoption metrics

- Set stop-loss orders to limit potential losses

ORO Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3% of crypto portfolio

- Aggressive investors: 5-10% of crypto portfolio

- Professional investors: Up to 15% of crypto portfolio

(2) Risk Hedging Solutions

- Diversification: Spread investments across multiple gaming tokens

- Stop-loss orders: Implement to limit potential losses

(3) Secure Storage Solutions

- Hot wallet recommendation: Gate Web3 wallet

- Cold storage solution: Hardware wallet for long-term holdings

- Security precautions: Enable two-factor authentication, use strong passwords

V. Potential Risks and Challenges for ORO

ORO Market Risks

- High volatility: Gaming tokens can experience significant price swings

- Competition: Other blockchain gaming projects may impact ORO's market share

- User adoption: Slow growth in player base could affect token value

ORO Regulatory Risks

- Unclear regulations: Gaming tokens may face regulatory scrutiny

- Geographical restrictions: Some regions may limit or ban crypto gaming platforms

- Tax implications: Evolving tax laws may impact gaming token investments

ORO Technical Risks

- Smart contract vulnerabilities: Potential for exploits or hacks

- Scalability issues: Game performance may be affected by network congestion

- Dependency on blockchain infrastructure: Issues with the underlying blockchain could impact ORO

VI. Conclusion and Action Recommendations

ORO Investment Value Assessment

ORO presents a high-risk, high-reward opportunity in the blockchain gaming sector. Long-term potential exists if Operon Origins gains traction, but short-term volatility and adoption risks remain significant.

ORO Investment Recommendations

✅ Beginners: Consider small, experimental positions to learn about gaming tokens ✅ Experienced investors: Implement dollar-cost averaging and set clear profit targets ✅ Institutional investors: Conduct thorough due diligence and consider ORO as part of a diversified gaming token portfolio

ORO Trading Participation Methods

- Spot trading: Purchase ORO tokens on Gate.com

- Staking: Participate in staking programs if offered by the Operon Origins platform

- In-game purchases: Use ORO tokens within the Operon Origins game ecosystem

Cryptocurrency investments carry extremely high risks, and this article does not constitute investment advice. Investors should make decisions carefully based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

What is the gold price forecast for 2025?

Gold price is expected to be around $3,941.65 per ounce in 2025, with analysts predicting a downward trend due to improved U.S.-China trade relations and reduced safe-haven demand.

Does Orca Crypto have a future?

Yes, Orca Crypto shows promise. By 2025, it's expected to see significant growth, driven by increased adoption and market demand in the DeFi space.

How much will 1 oz of gold be worth in 2030?

Based on current trends and predictions, 1 oz of gold is expected to be worth approximately $4,000 by 2030.

What is the price prediction for BTG in 2025?

Based on current market analysis, the price prediction for BTG in 2025 ranges between $4.07 and $5.19.

Share

Content