2025 STB Price Prediction: Navigating the Future of Stablecoin Markets

Introduction: STB's Market Position and Investment Value

Stabble (STB), as a new frictionless DEX on Solana, has processed over 50% of stablecoin volume since its inception, achieving significantly lower liquidity requirements compared to competitors. As of 2025, STB's market capitalization has reached $1,144,923, with a circulating supply of approximately 172,688,377 tokens, and a price hovering around $0.00663. This asset, dubbed the "Solana's Stablecoin Innovator," is playing an increasingly crucial role in decentralized finance and stablecoin trading.

This article will comprehensively analyze STB's price trends from 2025 to 2030, considering historical patterns, market supply and demand, ecosystem development, and macroeconomic factors, to provide investors with professional price forecasts and practical investment strategies.

I. STB Price History Review and Current Market Status

STB Historical Price Evolution Trajectory

- May 2025: STB reached its all-time high of $0.08, marking a significant milestone for the project.

- September 2025: The price dropped to its all-time low of $0.002942, indicating a substantial market correction.

- October 2025: STB has shown signs of recovery, with the price rebounding to $0.00663.

STB Current Market Situation

As of October 29, 2025, STB is trading at $0.00663, with a 24-hour trading volume of $26,213.07. The token has experienced a 0.68% increase in the last 24 hours and a significant 82.49% surge over the past 30 days. STB's market capitalization stands at $1,144,923.95, ranking it at 2737 in the global cryptocurrency market. The circulating supply is 172,688,377.98 STB, representing 34.54% of the total supply of 500,000,000 STB. The fully diluted valuation of the project is $3,315,000.

Click to view the current STB market price

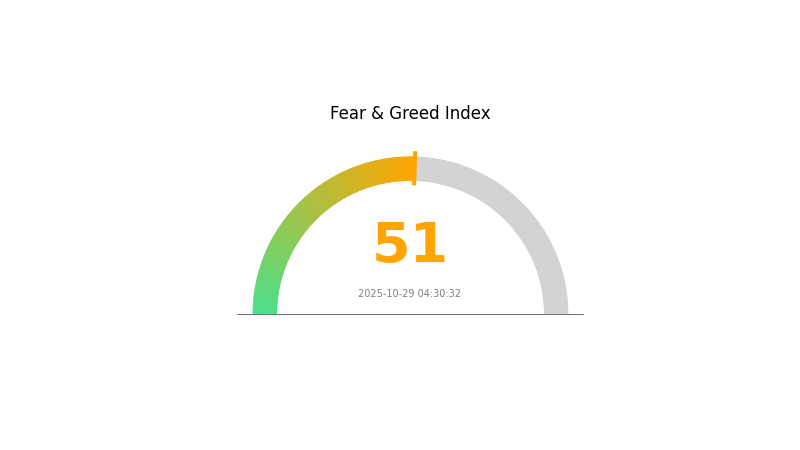

STB Market Sentiment Indicator

2025-10-29 Fear and Greed Index: 51 (Neutral)

Click to view the current Fear & Greed Index

The crypto market sentiment remains balanced today, with the Fear and Greed Index at 51, indicating a neutral stance. This suggests that investors are neither overly pessimistic nor excessively optimistic about the current market conditions. While caution is still advised, the neutral reading may present opportunities for both buyers and sellers. As always, it's crucial to conduct thorough research and consider your risk tolerance before making any investment decisions in the volatile crypto market.

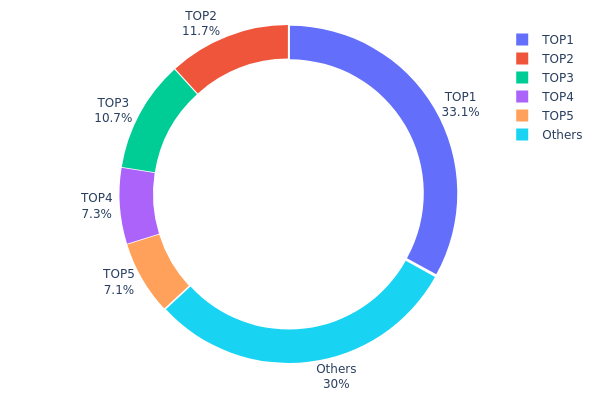

STB Holdings Distribution

The address holdings distribution data reveals a significant concentration of STB tokens among a few top addresses. The top address holds 33.06% of the total supply, while the top 5 addresses collectively control 69.93% of STB tokens. This high concentration suggests a potential centralization issue within the STB ecosystem.

Such a concentrated distribution raises concerns about market stability and vulnerability to price manipulation. With a single address controlling over one-third of the supply, there's a risk of significant market impact if large transactions occur. Furthermore, the top 5 addresses having nearly 70% of tokens could lead to coordinated actions affecting STB's price and liquidity.

This concentration also indicates a lower level of decentralization than ideal for a robust cryptocurrency ecosystem. While 30.07% of tokens are distributed among other addresses, the dominance of a few large holders may impact governance decisions and overall network resilience. Monitoring these top addresses' activities will be crucial for understanding potential market movements and assessing the long-term stability of STB's on-chain structure.

Click to view the current STB Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 8Fv7wW...T4pnRd | 156772.46K | 33.06% |

| 2 | DQa7BN...iyVo5W | 55689.21K | 11.74% |

| 3 | 6WSnxM...WXchUB | 50926.97K | 10.74% |

| 4 | EnvDUk...ejNn2P | 34619.34K | 7.30% |

| 5 | CqKDQS...NJJoVE | 33660.66K | 7.09% |

| - | Others | 142451.36K | 30.07% |

II. Key Factors Affecting STB's Future Price

Supply Mechanism

- Raw Material Prices: Fluctuations in raw material prices can significantly impact the production costs of STBs, potentially affecting their market price.

- Labor Costs: High labor costs are a major factor that can hinder market growth and challenge the expansion of the STB market in the forecast period.

Macroeconomic Environment

- Consumer Demand: Different consumer needs across regions influence the global STB market, with mature markets in North America and Europe driven by pay-TV companies upgrading their technology and bundled services.

- Regional Content Regulations: Content rules specific to different regions can impact the STB market, affecting both demand and pricing.

Technological Development and Ecosystem Building

- Digital Infrastructure: The functionality of digital infrastructure in various regions plays a crucial role in shaping the STB market.

- 4K UHD Technology: Despite limitations such as high prices for 4K UHDTV devices, limited availability of local 4K content, and bandwidth constraints, TV operators are committed to launching 4K UHD services and promoting them with STB upgrades.

- Ecosystem Applications: Pay-TV companies, particularly in North America and Europe, are upgrading their technologies and bundled services, indicating a growing ecosystem around STBs.

III. STB Price Prediction for 2025-2030

2025 Outlook

- Conservative prediction: $0.00516 - $0.00662

- Neutral prediction: $0.00662 - $0.00675

- Optimistic prediction: $0.00675 - $0.00688 (requires positive market sentiment)

2027-2028 Outlook

- Market stage expectation: Potential growth phase

- Price range forecast:

- 2027: $0.00424 - $0.01001

- 2028: $0.00433 - $0.01179

- Key catalysts: Increased adoption, market recovery, and project developments

2030 Long-term Outlook

- Base scenario: $0.00896 - $0.01227 (assuming steady market growth)

- Optimistic scenario: $0.01227 - $0.0157 (assuming strong market performance)

- Transformative scenario: $0.0157+ (assuming exceptional market conditions and widespread adoption)

- 2030-12-31: STB $0.0157 (potentially reaching yearly high)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.00688 | 0.00662 | 0.00516 | 0 |

| 2026 | 0.00716 | 0.00675 | 0.00574 | 1 |

| 2027 | 0.01001 | 0.00695 | 0.00424 | 4 |

| 2028 | 0.01179 | 0.00848 | 0.00433 | 27 |

| 2029 | 0.0144 | 0.01014 | 0.00902 | 52 |

| 2030 | 0.0157 | 0.01227 | 0.00896 | 85 |

IV. Professional Investment Strategies and Risk Management for STB

STB Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Long-term investors and believers in Solana's ecosystem

- Operation suggestions:

- Accumulate STB during market dips

- Set price targets and regularly review portfolio

- Store tokens in a secure Solana-compatible wallet

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Use to identify trends and potential entry/exit points

- Relative Strength Index (RSI): Monitor overbought/oversold conditions

- Key points for swing trading:

- Monitor Solana ecosystem developments

- Track STB's trading volume and liquidity

STB Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3% of crypto portfolio

- Aggressive investors: 5-10% of crypto portfolio

- Professional investors: Up to 15% of crypto portfolio

(2) Risk Hedging Solutions

- Diversification: Spread investments across multiple Solana projects

- Stop-loss orders: Set predetermined exit points to limit potential losses

(3) Secure Storage Solutions

- Hot wallet recommendation: Gate Web3 Wallet

- Cold storage solution: Hardware wallet supporting Solana tokens

- Security precautions: Enable two-factor authentication, use strong passwords

V. Potential Risks and Challenges for STB

STB Market Risks

- Volatility: High price fluctuations common in crypto markets

- Liquidity: Limited trading pairs may affect ease of buying/selling

- Competition: Other DEXs on Solana may impact STB's market share

STB Regulatory Risks

- Solana ecosystem regulations: Potential changes in regulatory stance

- Stablecoin scrutiny: Increased regulatory focus on stablecoin markets

- DEX compliance: Evolving regulations for decentralized exchanges

STB Technical Risks

- Smart contract vulnerabilities: Potential for exploits or bugs

- Solana network congestion: May impact transaction speed and fees

- Scalability challenges: Potential limitations as user base grows

VI. Conclusion and Action Recommendations

STB Investment Value Assessment

STB shows promise as a DEX token on Solana, with potential for growth. However, it faces significant competition and regulatory uncertainties in the short term.

STB Investment Recommendations

✅ Beginners: Start with small positions, focus on learning Solana ecosystem ✅ Experienced investors: Consider as part of a diversified Solana portfolio ✅ Institutional investors: Monitor project development and regulatory landscape

STB Trading Participation Methods

- Spot trading: Available on Gate.com

- Yield farming: Participate in liquidity provision on Stabble DEX

- Token staking: Look for staking opportunities if offered by the project

Cryptocurrency investments carry extremely high risks, and this article does not constitute investment advice. Investors should make decisions carefully based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

Is STB a buy?

Yes, STB could be a good buy. It has a low P/B ratio, suggesting it may be undervalued. The stock also offers a high dividend yield, making it attractive for income-seeking investors.

What is the prediction for stocks in 2025?

Stocks may remain volatile, with Big Tech and AI sectors likely outperforming. Higher valuations could limit market growth. Uncertainty due to global trade issues is expected.

What is the forecast for Secure Trust Bank?

The forecast for Secure Trust Bank in 2026 predicts a price of $471.35, representing a significant 48.43% decrease from current levels.

What is the best wallet token price prediction for 2030?

The best wallet token price prediction for 2030 is $0.82, based on anticipated crypto market growth and user base expansion.

Share

Content