2025 TRKX Price Prediction: Bullish Trends and Key Factors Influencing Future Growth

Introduction: TRKX's Market Position and Investment Value

Trakx (TRKX), as a regulated platform for crypto-index trading, has been offering thematic Crypto Tradable Indices (CTIs) and strategies since its inception. As of 2025, Trakx has a market capitalization of $545,711, with a circulating supply of approximately 714,375,221 tokens, and a price hovering around $0.0007639. This asset, known for its innovative approach to crypto-index trading, is playing an increasingly crucial role in the field of cryptocurrency investment and portfolio management.

This article will provide a comprehensive analysis of Trakx's price trends from 2025 to 2030, considering historical patterns, market supply and demand, ecosystem development, and macroeconomic factors, offering professional price predictions and practical investment strategies for investors.

I. TRKX Price History Review and Current Market Status

TRKX Historical Price Evolution

- 2024: Initial launch, price peaked at $0.08408 on October 15

- 2025: Market downturn, price dropped to an all-time low of $0.0005465 on June 30

TRKX Current Market Situation

As of October 30, 2025, TRKX is trading at $0.0007639, showing a 24-hour decline of 6.09%. The token has experienced significant volatility, with a 1-hour gain of 1.56% contrasting with larger losses over longer periods: -5.52% in 7 days, -27.24% in 30 days, and a substantial -96.1% over the past year.

TRKX's market capitalization stands at $545,711, with a circulating supply of 714,375,221 tokens out of a total supply of 1 billion. The fully diluted valuation is $763,900, indicating that 71.44% of the total supply is in circulation.

Trading volume in the last 24 hours reached $25,551, suggesting moderate market activity for this low-cap asset. The current price represents a 99.09% decrease from its all-time high, highlighting the significant downward pressure the token has faced since its peak.

Click to view the current TRKX market price

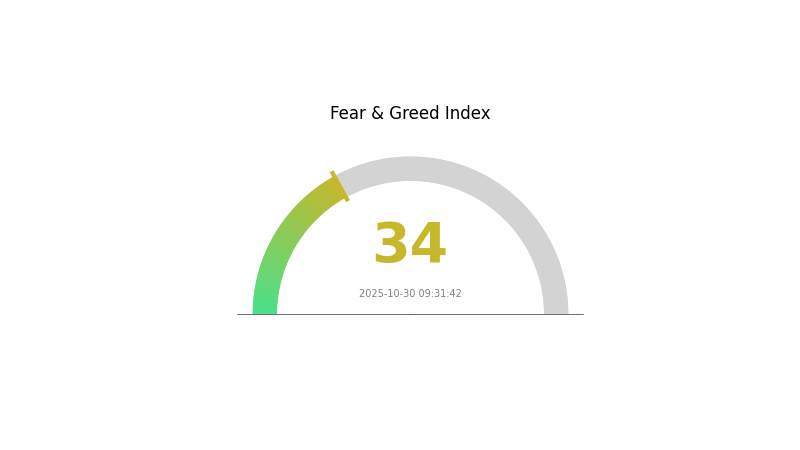

TRKX Market Sentiment Indicator

2025-10-30 Fear and Greed Index: 34 (Fear)

Click to view the current Fear & Greed Index

The crypto market sentiment remains cautious as the Fear and Greed Index hovers at 34, indicating a state of fear. This suggests investors are wary and potentially seeking safer assets. However, for contrarian traders, periods of fear can present buying opportunities. It's crucial to remember that market sentiment can shift rapidly, and investors should always conduct thorough research before making any decisions. Stay informed and trade wisely on Gate.com.

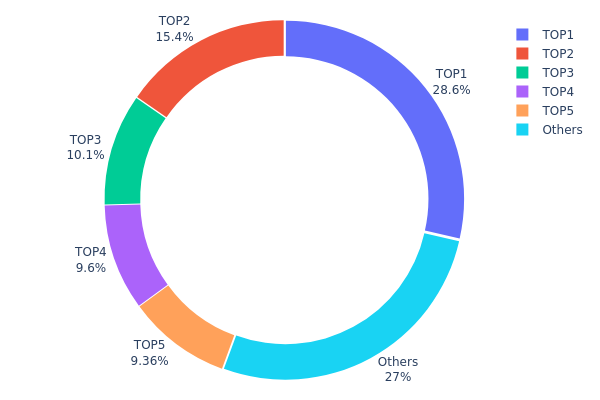

TRKX Holdings Distribution

The address holdings distribution data for TRKX reveals a significant concentration of tokens among a few top addresses. The top five addresses collectively hold 72.93% of the total supply, with the largest holder controlling 28.56%. This high concentration suggests a relatively centralized token distribution, which may have implications for market dynamics and price stability.

Such a concentrated distribution could potentially lead to increased price volatility if large holders decide to sell or move their assets. It also raises concerns about the possibility of market manipulation by these major stakeholders. However, the presence of a substantial "Others" category (27.07%) indicates some level of distribution among smaller holders, which could provide a degree of balance to the ecosystem.

The current distribution pattern reflects a market structure where a few key players have significant influence over TRKX's circulating supply. While this may raise questions about decentralization, it's important to note that such concentration is not uncommon in newer or smaller-cap cryptocurrencies. Monitoring changes in this distribution over time will be crucial for assessing the evolving health and stability of the TRKX market.

Click to view the current TRKX Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0xfbdc...9a05c9 | 285624.78K | 28.56% |

| 2 | 0x5711...bf734b | 153574.60K | 15.35% |

| 3 | 0x4858...1a3ccc | 100796.38K | 10.07% |

| 4 | 0xd394...7f97f9 | 95991.06K | 9.59% |

| 5 | 0x0d07...b492fe | 93615.63K | 9.36% |

| - | Others | 270397.56K | 27.07% |

II. Key Factors Affecting TRKX's Future Price

Supply Mechanism

- Reward Distribution: After the activity ends, 300 participants who complete all tasks will share $6,000 TRKX, with rewards directly distributed to participating wallets.

- Current Impact: The distribution of TRKX rewards may temporarily increase supply and potentially affect short-term price dynamics.

Institutional and Whale Dynamics

- Corporate Adoption: Trakx is a global fintech company creating new standards for digital asset investment.

Macroeconomic Environment

- Monetary Policy Impact: Investors need to carefully interpret signals to predict future policy directions of central banks. Fluctuations in macroeconomic data and changes in global geopolitical situations may influence decision-making processes, affecting market sentiment and asset prices.

- Geopolitical Factors: Global geopolitical situations can impact central bank decisions and subsequently influence market sentiment and asset prices.

Technical Development and Ecosystem Building

- Ecosystem Applications: Gate Web3 is mentioned in relation to TRKX, suggesting potential integration or partnership within the Gate.com ecosystem.

III. TRKX Price Prediction for 2025-2030

2025 Outlook

- Conservative prediction: $0.00049 - $0.00076

- Neutral prediction: $0.00076 - $0.00094

- Optimistic prediction: $0.00094 - $0.00111 (requires favorable market conditions)

2027-2028 Outlook

- Market phase expectation: Potential growth phase

- Price range forecast:

- 2027: $0.0007 - $0.00131

- 2028: $0.00077 - $0.00132

- Key catalysts: Increased adoption and technological advancements

2029-2030 Long-term Outlook

- Base scenario: $0.00124 - $0.00139 (assuming steady market growth)

- Optimistic scenario: $0.00153 - $0.00186 (assuming strong market performance)

- Transformative scenario: $0.00186+ (extreme favorable conditions)

- 2030-12-31: TRKX $0.00186 (potential peak price)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.00111 | 0.00076 | 0.00049 | 0 |

| 2026 | 0.00106 | 0.00094 | 0.00053 | 22 |

| 2027 | 0.00131 | 0.001 | 0.0007 | 30 |

| 2028 | 0.00132 | 0.00115 | 0.00077 | 50 |

| 2029 | 0.00153 | 0.00124 | 0.00116 | 62 |

| 2030 | 0.00186 | 0.00139 | 0.00134 | 81 |

IV. TRKX Professional Investment Strategies and Risk Management

TRKX Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Risk-tolerant investors with a long-term perspective

- Operation suggestions:

- Accumulate TRKX during market dips

- Set price targets for partial profit-taking

- Store tokens in secure non-custodial wallets

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Use to identify trend directions and potential reversals

- Relative Strength Index (RSI): Monitor overbought/oversold conditions

- Key points for swing trading:

- Monitor market sentiment and news related to Trakx

- Set stop-loss orders to manage downside risk

TRKX Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3% of crypto portfolio

- Aggressive investors: 5-10% of crypto portfolio

- Professional investors: Up to 15% of crypto portfolio

(2) Risk Hedging Solutions

- Diversification: Spread investments across various crypto assets

- Stop-loss orders: Implement to limit potential losses

(3) Secure Storage Solutions

- Hot wallet recommendation: Gate Web3 Wallet

- Cold storage solution: Hardware wallet for long-term holdings

- Security precautions: Use two-factor authentication, avoid public Wi-Fi for transactions

V. Potential Risks and Challenges for TRKX

TRKX Market Risks

- High volatility: Significant price fluctuations common in crypto markets

- Limited liquidity: Potential difficulty in executing large trades

- Market sentiment: Susceptible to rapid shifts in investor confidence

TRKX Regulatory Risks

- Regulatory uncertainty: Potential for changing regulations affecting crypto indices

- Compliance challenges: Evolving requirements for crypto platforms

- Cross-border restrictions: Varying legal status in different jurisdictions

TRKX Technical Risks

- Smart contract vulnerabilities: Potential for exploits in the underlying code

- Network congestion: Possible delays in transactions during high activity periods

- Integration issues: Challenges in maintaining compatibility with various blockchain networks

VI. Conclusion and Action Recommendations

TRKX Investment Value Assessment

TRKX offers exposure to a regulated crypto index trading platform, potentially providing a more stable investment compared to individual cryptocurrencies. However, it faces significant short-term risks due to market volatility and regulatory uncertainties.

TRKX Investment Recommendations

✅ Beginners: Consider small, experimental positions to understand the market dynamics ✅ Experienced investors: Implement a dollar-cost averaging strategy with strict risk management ✅ Institutional investors: Evaluate TRKX as part of a diversified crypto portfolio, focusing on its potential for institutional-grade crypto index exposure

TRKX Trading Participation Methods

- Spot trading: Purchase TRKX tokens on Gate.com

- Limit orders: Set buy and sell orders at predetermined price levels

- DCA strategy: Regularly invest fixed amounts to average out market volatility

Cryptocurrency investments carry extremely high risks, and this article does not constitute investment advice. Investors should make decisions carefully based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

Will trx coin reach $10?

While TRX has potential, reaching $10 is ambitious. Market trends and adoption rates are key factors, but no definitive prediction exists for such a high price point.

Does Tezos have a future?

Yes, Tezos has a promising future. Its ongoing development, community support, and potential for price growth in 2025-2030 indicate a positive outlook. Tezos continues to evolve with new features and upgrades.

How much will TRX be worth in 2025?

Based on machine learning projections, TRX is expected to reach a minimum price of $0.343675 and an average price of $0.350991 by 2025, showing potential growth from current levels.

What is the price prediction for Trac in 2025?

Based on technical analysis, the price prediction for TRAC in 2025 is a minimum of $0.438, with potential for higher growth.

Share

Content