2025 WAM Price Prediction: Analyzing Market Trends and Potential Growth Factors

Introduction: WAM's Market Position and Investment Value

WAM (WAM), as a play-to-earn encrypted gaming platform, has made significant strides since its inception in 2021. As of 2025, WAM's market capitalization has reached $642,311, with a circulating supply of approximately 679,479,421 tokens, and a price hovering around $0.0009453. This asset, dubbed the "casual tournament crypto reward," is playing an increasingly crucial role in the mobile gaming and cryptocurrency sectors.

This article will comprehensively analyze WAM's price trends from 2025 to 2030, considering historical patterns, market supply and demand, ecosystem development, and macroeconomic factors to provide investors with professional price predictions and practical investment strategies.

I. WAM Price History Review and Current Market Status

WAM Historical Price Evolution

- 2021: WAM reached its all-time high of $0.194038 on December 20, marking a significant milestone in its early trading history.

- 2023: The market experienced a downturn, with WAM hitting its all-time low of $0.00077968 on October 13, reflecting broader crypto market challenges.

- 2025: WAM has shown signs of stabilization, with the price currently at $0.0009453, indicating a slight recovery from its historical low.

WAM Current Market Situation

As of October 30, 2025, WAM is trading at $0.0009453, with a 24-hour trading volume of $60,689.02. The token has experienced a 2.24% decrease in the last 24 hours. WAM's market capitalization stands at $642,311.90, ranking it 3233rd in the overall cryptocurrency market. The circulating supply is 679,479,421 WAM tokens, which represents 67.95% of the total supply of 1 billion tokens. Despite recent price declines, WAM maintains a presence in the play-to-earn gaming sector, with its platform continuing to offer cryptocurrency rewards for tournament participation.

Click to view the current WAM market price

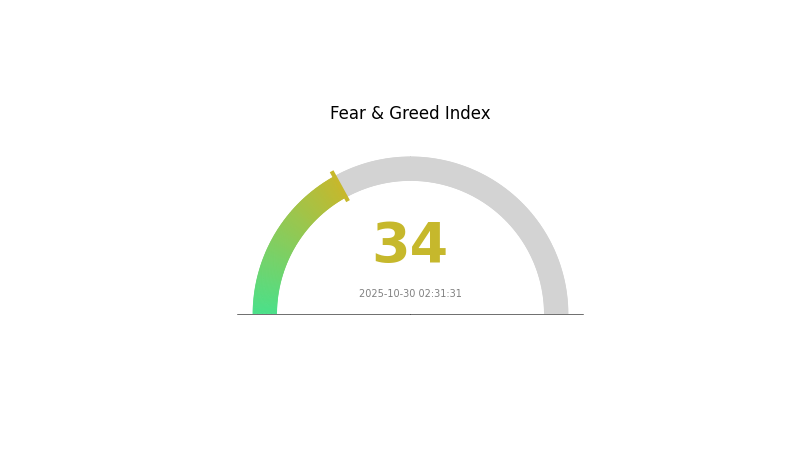

WAM Market Sentiment Indicator

2025-10-30 Fear and Greed Index: 34 (Fear)

Click to view the current Fear & Greed Index

The cryptocurrency market is currently experiencing a period of fear, with the Fear and Greed Index at 34. This sentiment indicates that investors are cautious and uncertain about market conditions. During such times, it's crucial to stay informed and make rational decisions. Some traders see fear as a potential buying opportunity, adhering to the adage "be fearful when others are greedy, and greedy when others are fearful." However, always conduct thorough research and consider your risk tolerance before making any investment decisions.

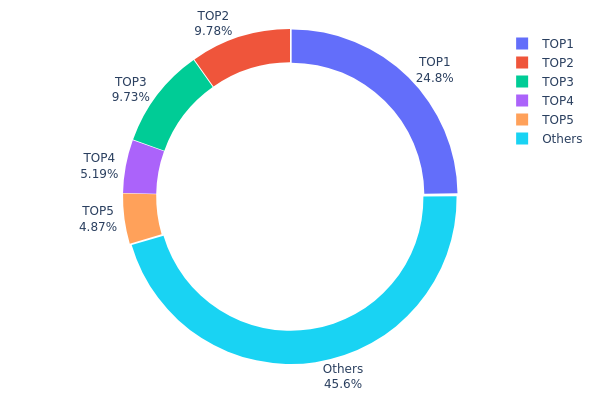

WAM Holdings Distribution

The address holdings distribution data provides crucial insights into the concentration of WAM tokens among different wallet addresses. Analysis of this data reveals a relatively high concentration of WAM tokens in a few top addresses. The top holder possesses 24.81% of the total supply, while the top five addresses collectively control 54.35% of WAM tokens.

This level of concentration raises potential concerns about market stability and decentralization. With over half of the tokens held by just five addresses, there's an increased risk of price manipulation or sudden market movements if these large holders decide to sell or move their assets. The significant holdings of the top address (24.81%) could particularly impact market dynamics if any major transactions occur.

However, it's worth noting that 45.65% of WAM tokens are distributed among other addresses, indicating some level of broader distribution. This distribution pattern suggests a mix of large institutional or early investors and a more diverse set of smaller holders. While the current concentration levels warrant careful monitoring, the presence of a substantial "Others" category indicates potential for increased decentralization over time.

Click to view the current WAM Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x8c06...e7d562 | 248121.62K | 24.81% |

| 2 | 0x1939...b2c5c2 | 97780.15K | 9.77% |

| 3 | 0xb3b2...eb5ac4 | 97333.33K | 9.73% |

| 4 | 0x0d07...b492fe | 51866.99K | 5.18% |

| 5 | 0xb9e2...512cf7 | 48666.67K | 4.86% |

| - | Others | 456231.24K | 45.65% |

II. Key Factors Influencing WAM's Future Price

Supply Mechanism

- Historical patterns: Past supply changes have had limited impact on price, as WAM's price is primarily demand-driven.

- Current impact: The current supply situation is expected to have minimal direct influence on WAM's price trajectory.

Institutional and Whale Dynamics

- Institutional holdings: Major central banks, particularly in emerging markets like China, Turkey, India, and Russia, have been significantly increasing their gold reserves.

- Corporate adoption: High-tech industries in China, such as semiconductors, aerospace, medical equipment, and precision instruments, are increasingly adopting gold for industrial applications.

- National policies: China's central bank is expected to continue increasing gold reserves as a strategic policy tool to address international situation changes.

Macroeconomic Environment

- Monetary policy impact: The Federal Reserve is anticipated to accelerate its rate cutting cycle in late 2025 and 2026, potentially weakening the dollar and boosting WAM's price.

- Inflation hedge properties: WAM has demonstrated strong performance as an inflation hedge, especially in high inflation environments.

- Geopolitical factors: Ongoing geopolitical tensions, including conflicts in Ukraine, Middle East, and India-Pakistan, are driving increased safe-haven demand for WAM.

Technical Development and Ecosystem Building

- De-dollarization trend: Many countries, especially emerging markets, are accelerating "de-dollarization" efforts, including cross-border local currency settlements, new payment systems, and digital currency development.

- Ecosystem applications: The expansion of WAM ETFs, futures, and other investment products is diversifying investment channels and increasing market interest in WAM-related assets.

III. WAM Price Prediction for 2025-2030

2025 Outlook

- Conservative prediction: $0.0009 - $0.00095

- Neutral prediction: $0.00095 - $0.0011

- Optimistic prediction: $0.0011 - $0.0013 (requires positive market sentiment)

2026-2027 Outlook

- Market stage expectation: Potential growth phase

- Price range forecast:

- 2026: $0.00066 - $0.00162

- 2027: $0.00118 - $0.00159

- Key catalysts: Increased adoption and market recovery

2028-2030 Long-term Outlook

- Base scenario: $0.00148 - $0.00228 (assuming steady market growth)

- Optimistic scenario: $0.00228 - $0.00272 (assuming strong bullish trends)

- Transformative scenario: $0.00272 - $0.00296 (extreme favorable conditions)

- 2030-12-31: WAM $0.00296 (potential peak price)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.0013 | 0.00095 | 0.0009 | 0 |

| 2026 | 0.00162 | 0.00112 | 0.00066 | 19 |

| 2027 | 0.00159 | 0.00137 | 0.00118 | 45 |

| 2028 | 0.00219 | 0.00148 | 0.00076 | 57 |

| 2029 | 0.00272 | 0.00184 | 0.00136 | 94 |

| 2030 | 0.00296 | 0.00228 | 0.00155 | 141 |

IV. WAM Professional Investment Strategies and Risk Management

WAM Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Risk-tolerant investors with a long-term perspective

- Operation suggestions:

- Accumulate WAM tokens during market dips

- Set price targets for partial profit-taking

- Store tokens in a secure wallet with regular backups

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Use to identify trends and potential reversal points

- Relative Strength Index (RSI): Monitor overbought/oversold conditions

- Key points for swing trading:

- Set strict stop-loss orders to manage downside risk

- Monitor game platform adoption metrics for potential price catalysts

WAM Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3% of crypto portfolio

- Aggressive investors: 5-10% of crypto portfolio

- Professional investors: Up to 15% of crypto portfolio

(2) Risk Hedging Solutions

- Diversification: Spread investments across multiple gaming tokens

- Stop-loss orders: Implement to limit potential losses

(3) Secure Storage Solutions

- Hot wallet recommendation: Gate Web3 Wallet

- Cold storage solution: Hardware wallet for long-term holdings

- Security precautions: Enable two-factor authentication, use strong passwords

V. Potential Risks and Challenges for WAM

WAM Market Risks

- Volatility: High price fluctuations common in small-cap tokens

- Liquidity: Limited trading volume may impact ease of entry/exit

- Competition: Increasing number of play-to-earn platforms entering the market

WAM Regulatory Risks

- Uncertain regulations: Potential for stricter oversight of play-to-earn models

- Tax implications: Evolving tax treatment of gaming rewards in various jurisdictions

- Platform compliance: Ongoing need to adapt to changing regulatory landscapes

WAM Technical Risks

- Smart contract vulnerabilities: Potential for exploits or bugs in the token contract

- Scalability challenges: Possible network congestion during peak usage periods

- Dependence on blockchain infrastructure: Susceptibility to broader network issues

VI. Conclusion and Action Recommendations

WAM Investment Value Assessment

WAM presents a speculative opportunity in the growing play-to-earn gaming sector. While the platform shows promise, investors should be aware of the high volatility and regulatory uncertainties associated with small-cap gaming tokens.

WAM Investment Recommendations

✅ Beginners: Consider small, experimental positions to understand the platform ✅ Experienced investors: Implement dollar-cost averaging with strict risk management ✅ Institutional investors: Conduct thorough due diligence and consider as part of a diversified gaming token portfolio

WAM Trading Participation Methods

- Spot trading: Available on Gate.com for direct token purchases

- Staking: Explore potential staking options on the WAM platform for passive income

- In-game participation: Engage with the WAM ecosystem to earn tokens through gameplay

Cryptocurrency investments carry extremely high risks, and this article does not constitute investment advice. Investors should make decisions cautiously based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

Is wam a good investment?

Yes, WAM shows promise as an investment. Its strong financial results and upgraded profit guidance indicate potential for growth and returns.

Will hamster kombat reach $1?

Yes, Hamster Kombat reached $1 in 2024. Analysts' predictions of a potential surge were confirmed by the current price.

What is the future outlook for village farms?

Village Farms' future outlook is cautiously optimistic. Stock prices are projected to range from $0.46 to $0.87 by 2030, with potential for growth based on current market trends.

What is the future prediction for WAN to USD rate?

Based on current trends, the WAN to USD rate is predicted to increase by 5% by 2026, reaching approximately $0.075815.

Share

Content