2025 ZF Price Prediction: Analyzing Market Trends and Potential Growth Factors for ZF Shares

Introduction: ZF's Market Position and Investment Value

zkSwap Finance (ZF) as the first Swap to Earn DeFi platform on the zkSync Era ecosystem, has pioneered a unique incentive model since its inception. As of 2025, ZF's market capitalization has reached $1,080,230, with a circulating supply of approximately 589,484,612 tokens, and a price hovering around $0.0018325. This asset, known as a "DeFi innovator," is playing an increasingly crucial role in decentralized finance and liquidity provision.

This article will comprehensively analyze ZF's price trends from 2025 to 2030, combining historical patterns, market supply and demand, ecosystem development, and macroeconomic environment to provide investors with professional price predictions and practical investment strategies.

I. ZF Price History Review and Current Market Status

ZF Historical Price Evolution Trajectory

- 2023: Project launch, price started at $0.0002

- 2024: Reached all-time high of $0.087 on March 5th

- 2025: Market downturn, price dropped to all-time low of $0.00155 on April 18th

ZF Current Market Situation

As of October 29, 2025, ZF is trading at $0.0018325, with a 24-hour trading volume of $27,291.12. The token has experienced a 3.48% decrease in the last 24 hours. ZF's market capitalization currently stands at $1,080,230.55, ranking it at 2789th position in the global cryptocurrency market.

The token's price is significantly below its all-time high of $0.087, representing a 97.89% decrease from its peak. However, it has shown some recovery from its all-time low of $0.00155, with an 18.23% increase from that point.

ZF's circulating supply is 589,484,612.24 tokens, which is 58.95% of its maximum supply of 1,000,000,000 tokens. The fully diluted market cap is $1,832,500.00.

In terms of recent price trends, ZF has shown negative performance across various timeframes:

- 1 hour: -0.12%

- 24 hours: -3.48%

- 7 days: -0.21%

- 30 days: -21.48%

- 1 year: -79.89%

These figures indicate a bearish sentiment in both short-term and long-term perspectives for ZF.

Click to view the current ZF market price

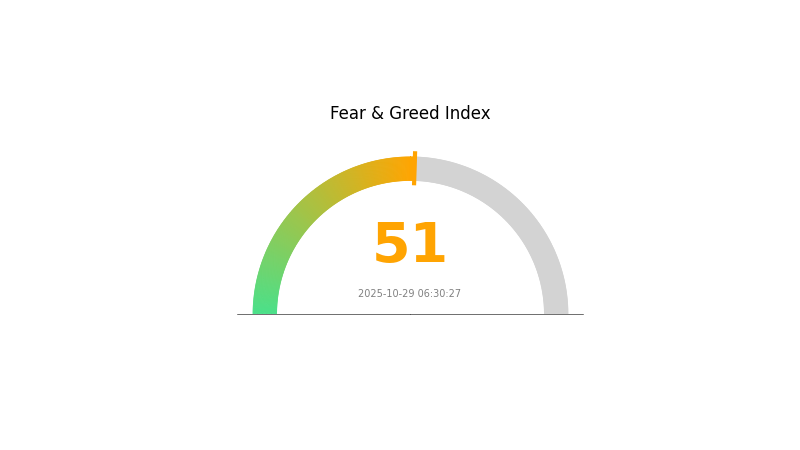

ZF Market Sentiment Indicator

2025-10-29 Fear and Greed Index: 51 (Neutral)

Click to view the current Fear & Greed Index

The cryptocurrency market sentiment remains balanced today, with the Fear and Greed Index at 51, indicating a neutral stance. This suggests that investors are neither overly optimistic nor pessimistic about the current market conditions. While some may see this as a sign of stability, others might interpret it as a lack of clear direction. Traders should remain cautious and conduct thorough research before making any investment decisions. Keep an eye on market trends and stay informed about potential catalysts that could shift sentiment in either direction.

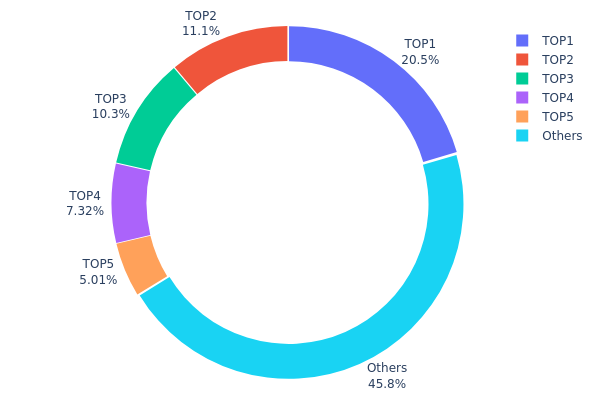

ZF Holdings Distribution

The address holdings distribution data provides crucial insights into the concentration of ZF tokens among different addresses. Analysis of this data reveals a significant level of centralization in ZF token ownership. The top five addresses collectively hold 54.19% of the total supply, with the largest single address controlling 20.47% of all tokens.

This concentration pattern raises concerns about potential market manipulation and price volatility. The top address, holding over one-fifth of the total supply, could exert substantial influence on market dynamics if it decides to liquidate or accumulate more tokens. Furthermore, the top three addresses combined control 41.87% of the supply, indicating a high degree of centralization that could impact the token's stability and decentralization efforts.

While 45.81% of tokens are distributed among other addresses, the current holding structure suggests a need for improved token distribution to enhance market resilience and reduce manipulation risks. This concentration level may also affect governance decisions if ZF implements a token-based voting system, potentially compromising the project's decentralization goals.

Click to view the current ZF Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x056f...dc0c8e | 161506.76K | 20.47% |

| 2 | 0xd33a...017e01 | 87874.75K | 11.13% |

| 3 | 0x7ab6...b6bbc7 | 81058.26K | 10.27% |

| 4 | 0xfe49...eaa34f | 57723.60K | 7.31% |

| 5 | 0x0d07...b492fe | 39558.94K | 5.01% |

| - | Others | 361125.26K | 45.81% |

II. Key Factors Affecting ZF's Future Price

Supply Mechanism

- Price Fluctuation Mechanism: The permit price is allowed to fluctuate freely between the minimum and maximum price limits, which can establish an additional mechanism to provide more predictability.

Institutional and Whale Dynamics

- National Policies: Environmental-related policy measures may impact the future price trends of ZF.

Macroeconomic Environment

- Impact of Monetary Policy: The US dollar index shows a generally negative correlation with commodity prices, which may influence ZF's price.

- Geopolitical Factors: International situations and geopolitical events can affect ZF's price movements.

Technical Development and Ecosystem Building

- Market Sentiment: Investor expectations and perceptions of economic fundamentals can significantly influence ZF's price trends.

- Technological Innovation: Ongoing technological advancements in the ZF ecosystem may impact its future price performance.

III. ZF Price Prediction for 2025-2030

2025 Outlook

- Conservative prediction: $0.00132 - $0.00183

- Neutral prediction: $0.00183 - $0.0022

- Optimistic prediction: $0.0022 - $0.0024 (requires favorable market conditions)

2027 Mid-term Outlook

- Market phase expectation: Potential growth phase

- Price range forecast:

- 2026: $0.0018 - $0.00262

- 2027: $0.0022 - $0.003

- Key catalysts: Increased adoption and technological improvements

2030 Long-term Outlook

- Base scenario: $0.00307 - $0.0041 (assuming steady market growth)

- Optimistic scenario: $0.0041 - $0.00545 (assuming strong market performance)

- Transformative scenario: $0.00545+ (assuming breakthrough innovations and mass adoption)

- 2030-12-31: ZF $0.00545 (potential peak price)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.0024 | 0.00183 | 0.00132 | 0 |

| 2026 | 0.00262 | 0.00211 | 0.0018 | 15 |

| 2027 | 0.003 | 0.00237 | 0.0022 | 29 |

| 2028 | 0.004 | 0.00269 | 0.00185 | 46 |

| 2029 | 0.00485 | 0.00334 | 0.00288 | 82 |

| 2030 | 0.00545 | 0.0041 | 0.00307 | 123 |

IV. Professional Investment Strategies and Risk Management for ZF

ZF Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Long-term investors with high risk tolerance

- Operational suggestions:

- Accumulate ZF tokens during market dips

- Stake ZF tokens to earn additional rewards

- Store tokens securely in a non-custodial wallet

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Use to identify trend directions and potential reversals

- Relative Strength Index (RSI): Monitor overbought/oversold conditions

- Key points for swing trading:

- Set clear entry and exit points based on technical indicators

- Use stop-loss orders to limit potential losses

ZF Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3% of crypto portfolio

- Aggressive investors: 5-10% of crypto portfolio

- Professional investors: Up to 15% of crypto portfolio

(2) Risk Hedging Solutions

- Diversification: Spread investments across multiple DeFi projects

- Options strategies: Consider using options to hedge against potential downside

(3) Secure Storage Solutions

- Hot wallet recommendation: Gate Web3 Wallet

- Cold storage solution: Use hardware wallets for long-term holdings

- Security precautions: Enable two-factor authentication, use strong passwords

V. Potential Risks and Challenges for ZF

ZF Market Risks

- High volatility: ZF price may experience significant fluctuations

- Liquidity risk: Low trading volume may lead to slippage during large trades

- Competition: Other DeFi projects may capture market share

ZF Regulatory Risks

- Uncertain regulatory environment: Potential for increased scrutiny of DeFi projects

- Compliance challenges: Adapting to evolving regulatory requirements

- Cross-border restrictions: Varying regulations across jurisdictions

ZF Technical Risks

- Smart contract vulnerabilities: Potential for exploits or bugs in the code

- Scalability issues: zkSync Era network may face congestion during high demand

- Interoperability challenges: Limited integration with other blockchain networks

VI. Conclusion and Action Recommendations

ZF Investment Value Assessment

ZF presents a high-risk, high-reward opportunity within the emerging zkSync Era ecosystem. While it offers innovative Swap to Earn mechanics, investors should be cautious due to market volatility and regulatory uncertainties.

ZF Investment Recommendations

✅ Newcomers: Consider small, experimental positions to learn about DeFi ✅ Experienced investors: Allocate a limited portion of portfolio, actively monitor market trends ✅ Institutional investors: Conduct thorough due diligence, consider as part of a diversified DeFi strategy

ZF Trading Participation Methods

- Spot trading: Buy and sell ZF tokens on Gate.com

- Yield farming: Provide liquidity to ZF pools for additional rewards

- Staking: Lock up ZF tokens to earn passive income

Cryptocurrency investments carry extremely high risks, and this article does not constitute investment advice. Investors should make decisions carefully based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

What is the share price target of ZF?

The share price target for ZF is projected to be $15,115.33, representing a potential upside of 17.05% from current levels.

Does ZRX have a future?

Yes, ZRX has a promising future. By 2025, it's projected to grow significantly, potentially reaching $0.2660. The token's utility in decentralized exchanges and ongoing protocol developments support its long-term prospects.

What is the price prediction for XRP in 2030?

Based on market analyses, XRP's price is predicted to reach between $35 and $50 by 2030, with an average estimate of $43.

What is the price prediction for Zil in 2025?

Based on long-term analysis, the price prediction for Zil in 2025 is approximately $0.0077 per coin. This forecast suggests a modest valuation for Zilliqa in the mid-2020s.

Share

Content