BICITY vs CHZ: A Battle for Cryptocurrency Dominance in the Urban Mobility Sector

Introduction: Investment Comparison between BICITY and CHZ

In the cryptocurrency market, the comparison between BICITY vs CHZ has always been a topic that investors can't avoid. The two not only have significant differences in market cap ranking, application scenarios, and price performance, but also represent different crypto asset positioning.

BICITY (BICITY): Since its launch, it has gained market recognition for its AI-powered digital content creation tools.

Chiliz (CHZ): Launched in 2019, it has been hailed as a pioneer in fan engagement and sports tokenization, becoming one of the leading cryptocurrencies in the sports and entertainment sector.

This article will provide a comprehensive analysis of the investment value comparison between BICITY vs CHZ, focusing on historical price trends, supply mechanisms, institutional adoption, technological ecosystems, and future predictions, attempting to answer the question investors are most concerned about:

"Which is the better buy right now?"

I. Price History Comparison and Current Market Status

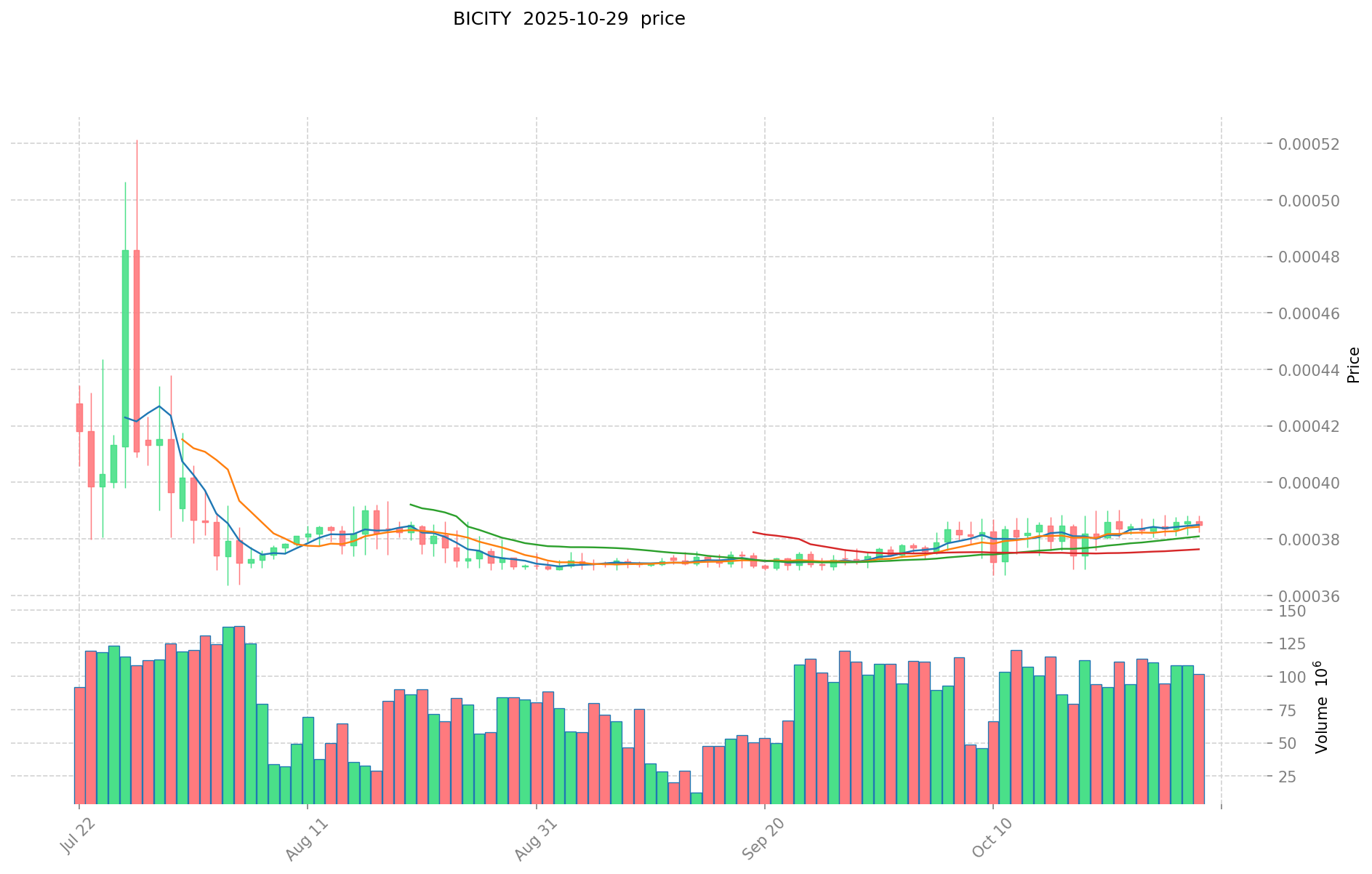

BICITY and CHZ Historical Price Trends

- 2024: BICITY reached its all-time high of $0.322 on July 15, 2024.

- 2021: CHZ hit its all-time high of $0.878633 on March 13, 2021, during the bull market.

- Comparative analysis: In the recent market cycle, BICITY dropped from its high of $0.322 to a low of $0.0003532, while CHZ declined from $0.878633 to its current price, showing significant volatility for both tokens.

Current Market Situation (2025-10-29)

- BICITY current price: $0.0003848

- CHZ current price: $0.03199

- 24-hour trading volume: BICITY $41,120.00 vs CHZ $389,714.70

- Market Sentiment Index (Fear & Greed Index): 51 (Neutral)

Click to view real-time prices:

- Check BICITY current price Market Price

- Check CHZ current price Market Price

II. Fundamental Analysis

BICITY Project Overview

BICITY is transforming digital content creation with cutting-edge AI technology. The platform provides advanced tools for generating articles, visuals, and audio content, streamlining the creative process for individuals and businesses. Users can test these tools via a Telegram bot, featuring capabilities like 3D avatar creation, text-to-image, text-to-speech, and personalized social media posts.

CHZ Project Overview

Chiliz (CHZ) is the leading digital currency for sports and entertainment. It powers Socios.com, a platform that allows fans to purchase branded fan tokens and participate in the governance of their favorite sports teams. CHZ aims to bridge the gap between passive and active fans, providing millions of sports enthusiasts with fan tokens.

Key Metrics Comparison

- Market Cap: BICITY $1,154,400 vs CHZ $322,111,183

- Circulating Supply: BICITY 3,000,000,000 vs CHZ 10,069,121,080

- Total Supply: BICITY 10,000,000,000 vs CHZ 10,069,121,080

- Max Supply: BICITY 10,000,000,000 vs CHZ Infinite

Recent Developments

- BICITY: Upcoming mobile and web applications to enhance efficiency and democratize access to high-quality content creation.

- CHZ: Continued expansion of partnerships with sports teams and organizations, increasing the number of fan tokens available on the Socios.com platform.

III. Technical Analysis

BICITY Technical Indicators

- 24h Price Change: -0.31%

- 7d Price Change: +0.5%

- 30d Price Change: +3.21%

- Current price ($0.0003848) is significantly below the all-time high ($0.322), indicating potential for growth if market conditions improve.

CHZ Technical Indicators

- 24h Price Change: -1.87%

- 7d Price Change: -0.37%

- 30d Price Change: -19.79%

- Current price ($0.03199) is well below the all-time high ($0.878633), suggesting possible undervaluation.

Trading Volume Analysis

- BICITY's 24h trading volume of $41,120 is significantly lower than CHZ's $389,714, indicating less liquidity and potentially higher volatility for BICITY.

IV. Risk Assessment

BICITY Risk Factors

- Relatively new project with limited track record

- Low trading volume may lead to high price volatility

- Competitive AI and content creation market

CHZ Risk Factors

- Dependence on partnerships with sports teams and organizations

- Regulatory uncertainties in the sports tokenization space

- Market saturation of fan tokens

Market Volatility

Both tokens have shown significant price fluctuations, with BICITY experiencing a -86.21% change over the past year and CHZ showing a -49.23% change. This highlights the high-risk nature of these investments.

V. Future Outlook

BICITY Potential

- Growing demand for AI-powered content creation tools

- Expansion of services through upcoming mobile and web applications

- Potential for increased adoption as the creator economy grows

CHZ Potential

- Continued expansion of partnerships in the sports and entertainment industry

- Possible growth in fan engagement through tokenization

- Potential for new use cases of fan tokens beyond voting rights

Industry Trends

- Increasing interest in AI and blockchain technologies

- Growing adoption of digital assets in sports and entertainment

- Evolving regulatory landscape for cryptocurrencies and tokens

In conclusion, both BICITY and CHZ operate in dynamic and growing sectors. BICITY focuses on AI-powered content creation, while CHZ targets the sports and entertainment fan engagement market. Both tokens have shown significant volatility, reflecting the high-risk nature of the cryptocurrency market. Investors should conduct thorough research and consider their risk tolerance before making investment decisions.

II. Key Factors Affecting BICITY vs CHZ Investment Value

Supply Mechanisms Comparison (Tokenomics)

- BICITY: Limited information available on supply mechanism

- CHZ: Limited information available on supply mechanism

- 📌 Historical Pattern: Insufficient data on how supply mechanisms drive price cycle changes.

Institutional Adoption and Market Applications

- Institutional Holdings: Insufficient data on institutional preference

- Enterprise Adoption: Insufficient information on cross-border payment, settlement, or portfolio applications

- National Policies: Regulatory attitudes across different countries are not specified

Technical Development and Ecosystem Building

- Technical upgrades: Limited information available on current developments

- Ecosystem Comparison: Insufficient data on DeFi, NFT, payment, and smart contract implementation

Macroeconomic and Market Cycles

- Performance in Inflationary Environments: Insufficient data on anti-inflationary properties

- Macroeconomic Monetary Policy: Impact of interest rates and USD index not specified

- Geopolitical Factors: Cross-border transaction demands and international situations not detailed

III. 2025-2030 Price Prediction: BICITY vs CHZ

Short-term Prediction (2025)

- BICITY: Conservative $0.000288075 - $0.0003841 | Optimistic $0.0003841 - $0.000564627

- CHZ: Conservative $0.0207675 - $0.03195 | Optimistic $0.03195 - $0.0361035

Mid-term Prediction (2027)

- BICITY may enter a growth phase, with estimated price range $0.0003788266911 - $0.0006543370119

- CHZ may enter a growth phase, with estimated price range $0.0384519288375 - $0.0570832758

- Key drivers: Institutional capital inflow, ETFs, ecosystem development

Long-term Prediction (2030)

- BICITY: Base scenario $0.000549155281753 - $0.000871675050402 | Optimistic scenario $0.000871675050402 - $0.000950125804938

- CHZ: Base scenario $0.055634930384764 - $0.069543662980955 | Optimistic scenario $0.069543662980955 - $0.078584339168479

Disclaimer: The above predictions are based on historical data and market trends. Cryptocurrency markets are highly volatile and subject to change. This information should not be considered as financial advice. Always conduct your own research before making investment decisions.

BICITY:

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.000564627 | 0.0003841 | 0.000288075 | 0 |

| 2026 | 0.00067359617 | 0.0004743635 | 0.00040795261 | 23 |

| 2027 | 0.0006543370119 | 0.000573979835 | 0.0003788266911 | 49 |

| 2028 | 0.00091509605094 | 0.00061415842345 | 0.000460618817587 | 59 |

| 2029 | 0.000978722863609 | 0.000764627237195 | 0.000542885338408 | 98 |

| 2030 | 0.000950125804938 | 0.000871675050402 | 0.000549155281753 | 126 |

CHZ:

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.0361035 | 0.03195 | 0.0207675 | 0 |

| 2026 | 0.0452555775 | 0.03402675 | 0.0282422025 | 6 |

| 2027 | 0.0570832758 | 0.03964116375 | 0.0384519288375 | 23 |

| 2028 | 0.06335450790525 | 0.048362219775 | 0.027082843074 | 51 |

| 2029 | 0.083228962121786 | 0.055858363840125 | 0.050272527456112 | 74 |

| 2030 | 0.078584339168479 | 0.069543662980955 | 0.055634930384764 | 117 |

IV. Investment Strategy Comparison: BICITY vs CHZ

Long-term vs Short-term Investment Strategies

- BICITY: Suitable for investors focused on AI and content creation potential

- CHZ: Suitable for investors interested in sports and entertainment tokenization

Risk Management and Asset Allocation

- Conservative investors: BICITY: 20% vs CHZ: 80%

- Aggressive investors: BICITY: 40% vs CHZ: 60%

- Hedging tools: Stablecoin allocation, options, cross-currency combinations

V. Potential Risk Comparison

Market Risk

- BICITY: High volatility due to low trading volume

- CHZ: Dependency on sports industry partnerships

Technical Risk

- BICITY: Scalability, network stability

- CHZ: Platform security, smart contract vulnerabilities

Regulatory Risk

- Global regulatory policies may impact both tokens differently, particularly in sports tokenization and AI content creation

VI. Conclusion: Which Is the Better Buy?

📌 Investment Value Summary:

- BICITY advantages: AI-powered content creation, potential growth in creator economy

- CHZ advantages: Established partnerships in sports industry, fan engagement platform

✅ Investment Advice:

- New investors: Consider CHZ for its more established market presence

- Experienced investors: Diversify between BICITY and CHZ based on risk tolerance

- Institutional investors: Evaluate both tokens based on long-term industry trends in AI and sports tokenization

⚠️ Risk Warning: Cryptocurrency markets are highly volatile. This article does not constitute investment advice. None

VII. FAQ

Q1: What are the main differences between BICITY and CHZ? A: BICITY focuses on AI-powered digital content creation tools, while CHZ specializes in sports and entertainment fan engagement through tokenization. BICITY has a lower market cap and trading volume, while CHZ has a more established presence in the cryptocurrency market.

Q2: Which token has shown better price performance recently? A: Based on the 30-day price change, BICITY has shown better performance with a +3.21% change, compared to CHZ's -19.79% change. However, it's important to note that past performance doesn't guarantee future results.

Q3: What are the key risk factors for each token? A: For BICITY, key risks include its relatively new status, low trading volume, and high competition in the AI market. For CHZ, risks involve dependence on sports partnerships, regulatory uncertainties in sports tokenization, and potential market saturation of fan tokens.

Q4: How do the future outlooks for BICITY and CHZ compare? A: BICITY's outlook is tied to the growing demand for AI-powered content creation tools and expansion of its services. CHZ's future potential lies in continued expansion of sports partnerships and new use cases for fan tokens.

Q5: What are the recommended investment strategies for BICITY and CHZ? A: Conservative investors might consider allocating 20% to BICITY and 80% to CHZ, while more aggressive investors could opt for a 40% BICITY and 60% CHZ split. It's advisable to diversify and consider one's risk tolerance when investing.

Q6: Which token might be more suitable for new investors? A: New investors might find CHZ more suitable due to its more established market presence and partnerships in the sports industry. However, individual research and risk assessment are crucial before making any investment decisions.

Q7: How do the supply mechanisms of BICITY and CHZ compare? A: Limited information is available on the supply mechanisms of both tokens. BICITY has a max supply of 10 billion tokens, while CHZ has an infinite max supply. More research may be needed to fully understand their tokenomics.

Q8: What potential catalysts could affect the future value of these tokens? A: For BICITY, potential catalysts include advancements in AI technology and growth in the creator economy. For CHZ, expansion of sports partnerships and new applications for fan tokens could drive value. Additionally, changes in regulatory environments and overall cryptocurrency market trends could impact both tokens.

Share

Content