RUNWAGO vs FLOW: Which Note-Taking App Reigns Supreme for Productivity Enthusiasts?

Introduction: RUNWAGO vs FLOW Investment Comparison

In the cryptocurrency market, the comparison between RUNWAGO and FLOW has been an unavoidable topic for investors. The two not only show significant differences in market cap ranking, application scenarios, and price performance, but also represent different positioning in the crypto asset space.

RUNWAGO (RUNWAGO): Since its launch, it has gained market recognition for its focus on SportFi revolution for runners worldwide.

FLOW (FLOW): Introduced in 2020, it has been hailed as a platform for next-generation games, applications, and digital assets, becoming one of the globally recognized cryptocurrencies in terms of trading volume and market capitalization.

This article will comprehensively analyze the investment value comparison between RUNWAGO and FLOW, focusing on historical price trends, supply mechanisms, institutional adoption, technological ecosystems, and future predictions, attempting to answer the question most concerning to investors:

"Which is the better buy right now?" I. Price History Comparison and Current Market Status

RUNWAGO (Coin A) and FLOW (Coin B) Historical Price Trends

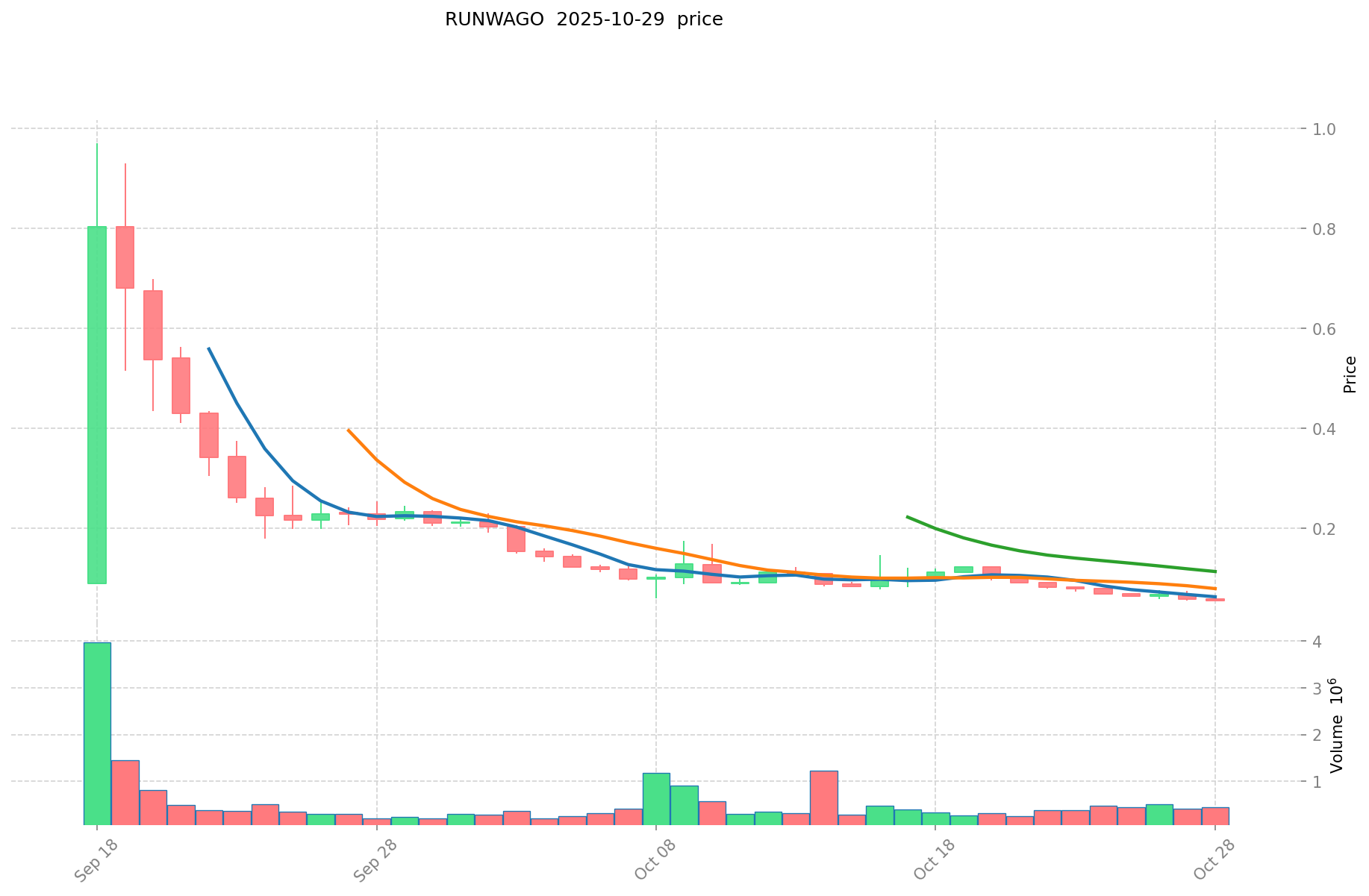

- 2025: RUNWAGO reached its all-time high of $0.97 on September 18, 2025, but has since experienced a significant decline.

- 2021: FLOW achieved its all-time high of $42.4 on April 5, 2021, demonstrating substantial volatility in the years since.

- Comparative Analysis: In the current market cycle, RUNWAGO has dropped from its peak of $0.97 to a low of $0.05055, while FLOW has fallen from its peak of $42.4 to current levels around $0.2746.

Current Market Situation (2025-10-30)

- RUNWAGO current price: $0.0523

- FLOW current price: $0.2746

- 24-hour trading volume: $30,881.47 (RUNWAGO) vs $990,243.53 (FLOW)

- Market Sentiment Index (Fear & Greed Index): 51 (Neutral)

Click to view real-time prices:

- Check RUNWAGO's current price Market Price

- Check FLOW's current price Market Price

II. Key Factors Affecting RUNWAGO vs FLOW Investment Value

Supply Mechanism Comparison (Tokenomics)

- RUNWAGO: Core value determined by ecosystem development and continuous value creation

- FLOW: Value driven primarily by supply-demand relationship

- 📌 Historical Pattern: Decentralization enhances security and reduces single-point-of-failure risks, becoming increasingly important for investor decisions

Institutional Adoption and Market Applications

- Institutional Holdings: Ecosystem building and sustainable value creation drive institutional interest

- Enterprise Adoption: Projects that gradually transform concepts into reality gain more meaningful traction

- Regulatory Attitudes: Market sentiment and macroeconomic policies (interest rates, inflation) significantly impact adoption

Technical Development and Ecosystem Building

- Technical Upgrades: Technological improvements contribute significantly to value appreciation

- Ecosystem Development: The true determinant of project value is ecosystem construction - when ecosystems create sustainable value, all elements within become increasingly valuable

- Ecosystem Comparison: Projects that allow gradual development and refinement show stronger long-term potential

Macroeconomic Factors and Market Cycles

- Performance in Inflationary Environments: Market sentiment influences performance during various economic conditions

- Macroeconomic Monetary Policy: Changes in institutional positions and regulatory dynamics affect valuation

- Geopolitical Factors: Web3 narratives like RWA (Real-World Assets) tokenization (including equity, bonds, real estate, gold, art, and AI computing power) represent emerging value drivers

III. 2025-2030 Price Prediction: RUNWAGO vs FLOW

Short-term Prediction (2025)

- RUNWAGO: Conservative $0.0456 - $0.0524 | Optimistic $0.0524 - $0.0582

- FLOW: Conservative $0.1887 - $0.2736 | Optimistic $0.2736 - $0.3447

Mid-term Prediction (2027)

- RUNWAGO may enter a growth phase, with expected prices $0.0300 - $0.0670

- FLOW may enter a bullish market, with expected prices $0.2978 - $0.4238

- Key drivers: Institutional capital inflow, ETF, ecosystem development

Long-term Prediction (2030)

- RUNWAGO: Base scenario $0.0755 - $0.0989 | Optimistic scenario $0.0989 - $0.1200

- FLOW: Base scenario $0.4894 - $0.7096 | Optimistic scenario $0.7096 - $0.8500

Disclaimer

RUNWAGO:

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.0582306 | 0.05246 | 0.0456402 | 0 |

| 2026 | 0.060326377 | 0.0553453 | 0.032653727 | 5 |

| 2027 | 0.06708957266 | 0.0578358385 | 0.03007463602 | 10 |

| 2028 | 0.0849492795888 | 0.06246270558 | 0.0537179267988 | 19 |

| 2029 | 0.07739129221362 | 0.0737059925844 | 0.061913033770896 | 40 |

| 2030 | 0.098968721542703 | 0.07554864239901 | 0.039285294047485 | 44 |

FLOW:

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.344736 | 0.2736 | 0.188784 | 0 |

| 2026 | 0.45447696 | 0.309168 | 0.20714256 | 12 |

| 2027 | 0.4238229528 | 0.38182248 | 0.2978215344 | 38 |

| 2028 | 0.467274351024 | 0.4028227164 | 0.358512217596 | 46 |

| 2029 | 0.54381066714 | 0.435048533712 | 0.41764659236352 | 58 |

| 2030 | 0.7096729206177 | 0.489429600426 | 0.27408057623856 | 78 |

IV. Investment Strategy Comparison: RUNWAGO vs FLOW

Long-term vs Short-term Investment Strategies

- RUNWAGO: Suitable for investors focused on SportFi and ecosystem potential

- FLOW: Suitable for investors seeking established platforms for games and digital assets

Risk Management and Asset Allocation

- Conservative investors: RUNWAGO: 20% vs FLOW: 80%

- Aggressive investors: RUNWAGO: 40% vs FLOW: 60%

- Hedging tools: Stablecoin allocation, options, cross-currency portfolios

V. Potential Risk Comparison

Market Risks

- RUNWAGO: Higher volatility due to smaller market cap and newer project status

- FLOW: Susceptible to broader crypto market trends and competition in the NFT/gaming space

Technical Risks

- RUNWAGO: Scalability, network stability

- FLOW: Computing power concentration, potential security vulnerabilities

Regulatory Risks

- Global regulatory policies may impact both differently, with FLOW potentially facing more scrutiny due to its wider adoption

VI. Conclusion: Which Is the Better Buy?

📌 Investment Value Summary:

- RUNWAGO advantages: Focus on SportFi revolution, potential for growth in a niche market

- FLOW advantages: Established platform, wider adoption in gaming and NFT sectors

✅ Investment Advice:

- New investors: Consider a smaller allocation to RUNWAGO for higher risk/reward, larger allocation to FLOW for stability

- Experienced investors: Balanced portfolio with both, adjusting based on risk tolerance

- Institutional investors: FLOW may be more suitable due to liquidity and market cap, consider RUNWAGO for diversification

⚠️ Risk Warning: The cryptocurrency market is highly volatile. This article does not constitute investment advice. None

VII. FAQ

Q1: What are the main differences between RUNWAGO and FLOW? A: RUNWAGO focuses on the SportFi revolution for runners, while FLOW is a platform for next-generation games, applications, and digital assets. RUNWAGO is newer with a smaller market cap, while FLOW is more established with wider adoption.

Q2: Which cryptocurrency has performed better historically? A: FLOW has reached a higher all-time high of $42.4 in April 2021, compared to RUNWAGO's all-time high of $0.97 in September 2025. However, both have experienced significant declines since their peaks.

Q3: What are the current prices and trading volumes for RUNWAGO and FLOW? A: As of October 30, 2025, RUNWAGO's price is $0.0523 with a 24-hour trading volume of $30,881.47. FLOW's price is $0.2746 with a 24-hour trading volume of $990,243.53.

Q4: How do the supply mechanisms differ between RUNWAGO and FLOW? A: RUNWAGO's core value is determined by ecosystem development and continuous value creation, while FLOW's value is primarily driven by the supply-demand relationship.

Q5: What are the long-term price predictions for RUNWAGO and FLOW? A: By 2030, RUNWAGO is predicted to reach $0.0755 - $0.1200, while FLOW is expected to reach $0.4894 - $0.8500 in the base and optimistic scenarios, respectively.

Q6: How should investors allocate their assets between RUNWAGO and FLOW? A: Conservative investors might consider allocating 20% to RUNWAGO and 80% to FLOW, while aggressive investors might opt for 40% RUNWAGO and 60% FLOW. However, individual allocations should be based on personal risk tolerance and investment goals.

Q7: What are the main risks associated with investing in RUNWAGO and FLOW? A: RUNWAGO faces higher volatility due to its smaller market cap and newer status, while FLOW is more susceptible to broader crypto market trends and competition in the NFT/gaming space. Both face potential regulatory risks, with FLOW potentially facing more scrutiny due to its wider adoption.

Share

Content